Thursday, July 4, 2024 05:54 PM

Federal Reserve considers interest rate cuts amid positive market movements

- US retail sales below expectations signal potential interest rate cuts

- London Stock Exchange surpasses as Europe's largest market by valuation

- Tech giants drive record closes in S&P 500 and Nasdaq

Image Credits: TKer by Sam Ro

Image Credits: TKer by Sam RoGlobal stock markets show resilience as US retail sales fall, London Stock Exchange leads, tech giants drive record highs.

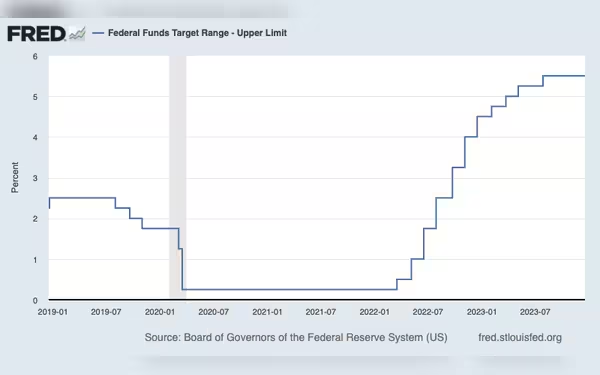

Stock markets around the world experienced a mix of positive movements on Tuesday, influenced by various economic indicators. The decrease in US retail sales raised expectations of potential interest rate cuts by the Federal Reserve, while concerns over political outcomes in France also played a role in shaping market sentiment. London Stock Exchange reclaimed its position as Europe's largest stock market by valuation, adding to the overall optimism in trading.

The upbeat mood was further fueled by record closes in the S&P 500 and Nasdaq, driven by investments in tech giants like Apple, Intel, and Microsoft. This surge was attributed to the positive outlook surrounding artificial intelligence. While major European markets closed in positive territory, Wall Street saw more subdued movements, with modest gains in the Dow and S&P 500, and a slight dip in the Nasdaq.

The US retail sales figures for May falling below expectations for the second consecutive month were viewed positively by the Federal Reserve. This trend indicates a potential cooling off of consumer demand, which could lead to future interest rate cuts to manage inflation effectively. Additionally, US factory output in May exceeded forecasts, contributing to the overall positive market sentiment.

Asian markets also saw gains, with several key indices closing higher. However, Hong Kong experienced a reversal in its early gains, ending the session in negative territory. In Europe, Frankfurt, Paris, and London continued their positive momentum, with London witnessing a notable increase driven by investment firm Hargreaves Lansdown's surge following a takeover proposal.

The market movements were influenced by a combination of factors, including economic data from the US and Europe, as well as developments in the energy market. West Texas Intermediate prices rose by 1.4 percent to $81.44 per barrel, reflecting the overall positive sentiment in the markets.

The global stock markets displayed resilience and optimism amidst various economic indicators and geopolitical uncertainties. The potential for interest rate cuts in the US, coupled with positive industrial output figures, contributed to the overall positive movements. Investors remain cautiously optimistic, closely monitoring developments in key markets to navigate the evolving economic landscape.