Tuesday, July 2, 2024 03:21 PM

IMF Surcharges Exacerbate Financial Strain on Vulnerable Nations

- IMF surcharges burden middle and lower-income countries financially

- Debt-ridden nations pay $6.4 billion in surcharges from 2020-2023

- Global debt levels hit record high, emerging economies face unprecedented challenges

Image Credits: CADTM

Image Credits: CADTMThe IMF's surcharges are adding to the financial woes of indebted countries, exacerbating debt distress and diverting resources from economic recovery efforts. Global debt levels have soared, particularly affecting emerging economies.

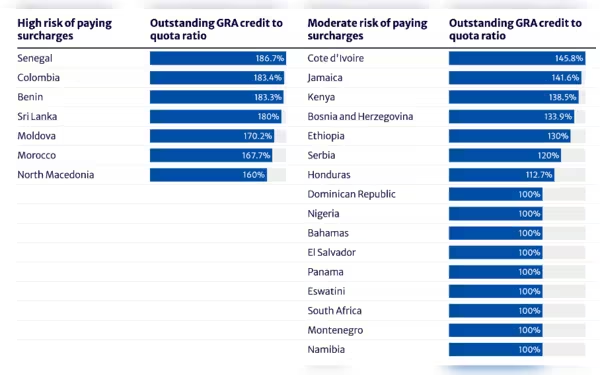

Countries, especially those in the middle and lower-income brackets, are facing a significant financial burden due to surcharges imposed on their borrowings from the International Monetary Fund (IMF). A recent report by US think tanks highlighted that indebted member countries have paid approximately $6.4 billion in surcharges between 2020 and 2023. The number of countries subject to these surcharges has more than doubled in the last four years, indicating a growing issue of global inequities.

The IMF is projected to collect an estimated $9.8 billion in surcharges over the next five years, further exacerbating the financial strain on struggling economies. Critics argue that these surcharges, in addition to the already steep basic rates, do not expedite repayment but rather hinder countries facing liquidity challenges, elevate the risk of debt distress, and divert essential resources away from economic recovery efforts.

Countries such as Ukraine, Egypt, Argentina, Barbados, and Pakistan bear the brunt of these surcharges, accounting for 90% of the IMF's surcharge revenues. These additional fees, constituting the IMF's primary revenue source, make up 50% of the total revenue in 2023. Kevin Gallagher, Director of the Global Development Policy Center, emphasized that IMF surcharges exacerbate economic pressures on vulnerable nations, particularly during global shocks.

Recent data from the Institute of International Finance revealed that global debt levels reached a record high of $313 trillion in 2023. Moreover, the debt-to-GDP ratio in emerging economies surged to unprecedented levels, underscoring the financial challenges faced by these nations. In response to these concerns, IMF shareholders have acknowledged the necessity of addressing the difficulties encountered by low-income countries, as stated by Managing Director Kristalina Georgieva.