Thursday, July 4, 2024 05:59 PM

Investors bullish on copper amid price surge

- Copper prices hit unprecedented levels due to short covering and speculation

- Robust demand from electric vehicle sector and data centers driving copper prices

- Market optimistic about long-term copper price sustainability despite short-term concerns

Image Credits: brecorder

Image Credits: brecorderCopper prices skyrocketed due to short covering and speculation, driven by demand from electric vehicles and data centers. Despite short-term worries, the market remains optimistic about long-term sustainability.

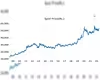

Copper prices soared to unprecedented levels on Monday as a result of a surge driven by short covering, prompting speculators and funds to place bets on the metal widely used in the power and construction industries. Short positions, typically used by producers to hedge their output, have also become a tool for traders and funds to speculate on lower prices.

The benchmark copper on the London Metal Exchange (LME) experienced a remarkable 2.7% increase, hitting $10,958 per metric ton and peaking at $11,104.5, representing a substantial 30% surge since the start of the year. This surge was fueled by a combination of short covering and heightened speculation by funds, particularly with significant involvement from Chinese market participants.

Meanwhile, COMEX copper prices achieved an all-time high of $5.1985 per pound, equivalent to $11,460 per ton, due to a scenario of short squeeze where parties are forced to repurchase their short positions at a loss or deliver physical copper to close them out. Analysts at ING have observed a bullish sentiment prevailing in the copper market, primarily fueled by speculative trading activities.

Despite lingering short-term concerns, especially related to China, the market is optimistic about robust cyclical consumption, increasing demand from the electric vehicle sector, and emerging applications such as data centers for artificial intelligence, which are expected to uphold elevated copper prices in the long term. Investors are gradually becoming less anxious about cyclical factors and are witnessing a stabilization in global Purchasing Managers' Index (PMI) figures.

In the broader metal market landscape, aluminium, zinc, lead, tin, and nickel also witnessed price hikes on Monday, reflecting positive market sentiment and signaling potential for further growth.

The surge in copper prices driven by short covering and speculation has captured the attention of market participants worldwide. With a combination of factors such as increased demand from various sectors and positive market sentiment, the outlook for copper prices remains optimistic in the long run. Investors are closely monitoring developments in the metal market, anticipating further growth and potential opportunities for investment.