Thursday, July 4, 2024 06:27 PM

RBI's Intervention Stabilizes Indian Rupee Amid Global Pressures

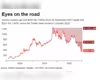

- Indian rupee hits record low against US dollar due to global factors

- RBI likely intervened to prevent significant depreciation of rupee

- Global economic indicators and geopolitical tensions contribute to bearish sentiment

Image Credits: Times Now

Image Credits: Times NowThe Indian rupee reached a record low against the US dollar due to global pressures, including US Treasury yield movements and geopolitical tensions in the Middle East. The RBI's intervention helped stabilize the currency amidst ongoing market uncertainties.

The Indian rupee hit a record low on Tuesday, dropping to 83.5350 against the US dollar before slightly recovering to 83.4875. This decline was influenced by the increase in US Treasury yields, fueled by expectations that the Federal Reserve may postpone rate cuts. Additionally, concerns over escalating tensions in the Middle East added to the pressure on the rupee.

Market analysts noted that the Reserve Bank of India likely intervened through state-run banks to prevent a significant depreciation of the rupee. Kunal Kurani from Mecklai Financial highlighted that the RBI's intervention helped stabilize the currency, averting a more substantial decline.

Global factors, such as the strengthening of the dollar index to a six-month high and the rise in US retail sales exceeding expectations, contributed to the overall bearish sentiment in Asian currencies. The prospect of a delayed Fed rate cut further dampened market sentiment, leading to a surge in US Treasury yields.

Amidst these developments, concerns about potential retaliation between Israel and Iran following recent events added to the apprehension surrounding the rupee and other Asian currencies. Israeli Prime Minister Benjamin Netanyahu's convening of the war cabinet underscored the heightened tensions in the region.

In conclusion, the Indian rupee's record low against the US dollar reflects a combination of domestic and international factors, including US Treasury yield movements, geopolitical tensions in the Middle East, and global economic indicators. The RBI's intervention and ongoing market uncertainties highlight the challenges faced by emerging market currencies in a volatile global environment.