Sunday, December 22, 2024 08:40 AM

Pakistan Stock Exchange Surges Past 98,000 Points

- KSE-100 index surpasses 98,000 points milestone.

- Banking sector rallies on speculation of SBP relaxations.

- Investors shift from fixed-income to equities for better returns.

Image Credits: dawn

Image Credits: dawnThe PSX's KSE-100 index surpasses 98,000 points, driven by investor confidence and banking sector speculation.

The Pakistan Stock Exchange (PSX) has been experiencing a remarkable surge, with the benchmark KSE-100 index recently surpassing the significant milestone of 98,000 points. This bullish momentum is a reflection of the growing confidence among investors, driven by various factors that have positively influenced market performance.

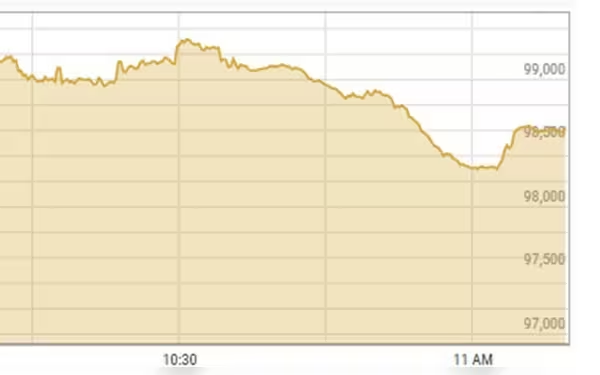

On Monday, the PSX witnessed an impressive gain of over 600 points during intraday trading. The KSE-100 index climbed by 621.85 points, or 0.64 percent, reaching 98,420.08 points before settling at 98,079.78 points, marking an increase of 281.55 points from the previous close. Such fluctuations in the stock market are not uncommon, but the current rally has caught the attention of many analysts and investors alike.

Market experts attribute this surge to “unconfirmed speculation” regarding potential relaxations by the State Bank of Pakistan (SBP) on minimum deposit rates (MDR) for banks. This speculation has sparked optimism among investors, particularly in the banking sector. The director of research at Chase Securities noted that a rally in banking stocks, fueled by rumors of the removal of the advance-to-deposit ratio (ADR) tax and changes in MDR, has significantly contributed to the market's strong performance.

Leading banks such as Bank Al Habib, Meezan Bank, Bank Alfalah, and MCB have been at the forefront of this surge. The influx of funds into the equity market, as both individuals and institutions shift their investments from fixed-income options to equities, has played a crucial role in this upward trend. This shift is largely due to declining yields in fixed-income investments, prompting investors to seek better returns in the stock market.

Despite the ongoing political uncertainties in the country, the market has shown resilience, largely ignoring the noise surrounding it. Experts recommend that retail investors adopt a long-term investment strategy, emphasizing the importance of avoiding knee-jerk reactions to short-term market fluctuations. A disciplined approach, which involves saving and investing small amounts regularly in a diversified portfolio while considering liquidity needs, is deemed a prudent strategy.

Furthermore, the anticipated exemption of commercial banks from ADR taxation has also positively influenced the index's performance. This expectation has provided additional support to the market, allowing it to maintain its upward momentum despite external challenges.

The current bullish trend at the PSX highlights the dynamic nature of the stock market and the various factors that can influence investor behavior. As the market continues to evolve, it is essential for investors to stay informed and adopt strategies that align with their financial goals. By focusing on long-term investments and remaining cautious amid market fluctuations, investors can navigate the complexities of the stock market more effectively.