Sunday, December 22, 2024 03:01 AM

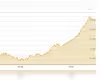

Pakistan Stock Exchange Surpasses 100,000 Points

- PSX crosses historic 100,000-point milestone.

- Investor confidence surges amid positive economic indicators.

- Cautious optimism advised for future market trends.

Image Credits: thenews.com.pk

Image Credits: thenews.com.pkThe Pakistan Stock Exchange has crossed the 100,000-point mark, reflecting strong investor confidence and positive economic trends.

The Pakistan Stock Exchange (PSX) has made headlines by crossing the remarkable 100,000-point mark on Thursday. This achievement is not just a number; it represents a significant milestone in the financial landscape of Pakistan. Investors are buzzing with excitement, as this historic high reflects strong confidence in the market, driven by positive economic indicators.

In recent months, the PSX has shown resilience and growth, which can be attributed to several encouraging economic trends. Analysts have noted that a decline in yields and lower inflation expectations are playing a crucial role in boosting investor sentiment. When investors feel confident about the economy, they are more likely to invest in stocks, which in turn drives the market higher.

Crossing the 100,000-point threshold is a clear signal that the PSX is on an upward trajectory. This milestone not only highlights the potential for growth in the Pakistani economy but also attracts foreign investment, which is vital for further development. As more investors pour money into the market, it creates a ripple effect, benefiting various sectors and ultimately contributing to economic stability.

However, it is essential to approach this achievement with a balanced perspective. While the current trends are promising, investors should remain cautious and informed. The stock market can be unpredictable, and what goes up can also come down. Therefore, it is crucial for investors to conduct thorough research and consider various factors before making investment decisions.

The PSX crossing the 100,000-point mark is a significant event that reflects the growing confidence in Pakistan's economy. It serves as a reminder of the potential for growth and prosperity in the financial markets. As the economy continues to evolve, staying informed and making wise investment choices will be key for both seasoned investors and newcomers alike. The journey ahead may be filled with opportunities, and it is up to the investors to seize them wisely.