Saturday, November 16, 2024 05:53 PM

Pakistan Stock Market Approaches 86,000 Points Amid Positive Sentiment

- KSE-100 index briefly crosses 86,000 points.

- Strong remittances and banking stocks drive market gains.

- Foreign investors remain net sellers amid volatility.

Image Credits: dawn

Image Credits: dawnThe Pakistan stock market shows resilience, nearing 86,000 points, driven by remittances and banking stocks despite foreign selling.

KARACHI: The stock market in Pakistan has been on a remarkable winning streak, continuing for the seventh consecutive session. On Wednesday, the market briefly crossed the significant milestone of 86,000 points, driven by higher remittances and a reduction in political tensions. Investors are also speculating about strong corporate earnings, which has added to the positive sentiment in the market.

Despite facing aggressive foreign selling, the KSE-100 index managed to reach an all-time high, albeit with modest gains. Ahsan Mehanti from Arif Habib Corporation noted that the surge was largely supported by banking stocks. This was after the State Bank of Pakistan made changes to the exposure limits for small and medium enterprises, alongside a notable 29% year-on-year increase in remittances, which reached $2.8 billion in September.

However, the market did experience some mid-session selling, primarily due to falling global crude oil prices and continued foreign outflows. According to Topline Securities Ltd, the KSE-100 index showed significant volatility, peaking at 86,451 points before dipping to 85,444 points. This fluctuation was mainly attributed to profit-taking and the index's struggle to maintain gains above the 86,000 mark. Nevertheless, institutional buying provided support, leading to a positive closing.

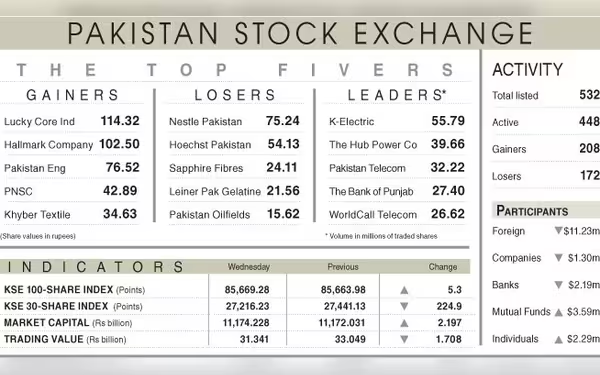

By the end of the trading session, the benchmark index posted a modest gain of 5.3 points, closing at 85,669.28. Key contributors to this increase included MCB Bank, Lucky Core Industries, Bank Al-Habib, Hub Power, and Habib Bank, which collectively added 292 points to the index. On the other hand, companies like Fauji Fertiliser, Engro Fertiliser, and Pakistan Oilfield saw their share prices decline, contributing to a loss of 215 points.

The trading volume also saw an increase of 17.66% to 596.05 million shares, although the traded value fell by 5.17% to Rs31.34 billion compared to the previous day. Notable stocks contributing to the trading volume included K-Electric with 55.79 million shares, Hub Power Company with 39.66 million shares, and Pakistan Telecom with 32.22 million shares.

In terms of price changes, Lucky Core Industries saw the most significant increase, rising by Rs114.32, followed by Hallmark Company at Rs102.50. Conversely, Nestle Pakistan experienced the largest drop, losing Rs75.24, followed by Hoechst Pakistan at Rs54.13.

Foreign investors remained net sellers, offloading shares worth $11.23 million. However, mutual funds continued their buying spree, acquiring shares worth $3.50 million. This mixed activity in the market reflects the ongoing uncertainty and volatility that investors are navigating.

While the stock market is showing signs of resilience with its recent performance, investors should remain cautious. The interplay of local and global economic factors, along with political developments, will continue to influence market dynamics. Staying informed and making well-researched investment decisions will be crucial for navigating this ever-changing landscape.