Thursday, July 4, 2024 07:09 PM

Pakistan's Branchless Banking Sector Hits 1 Billion Transactions Milestone

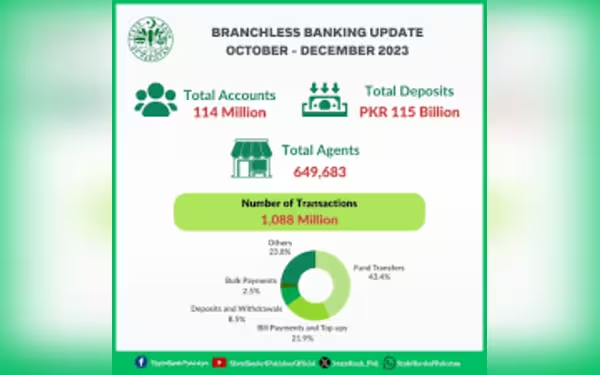

- 1 billion transactions recorded in a single quarter, historic achievement

- Bill payments and fund transfers major contributors to transaction volume

- Notable year-on-year growth in transaction volume and value

Image Credits: ProPakistani

Image Credits: ProPakistaniPakistan's branchless banking sector reaches a historic milestone with over 1 billion transactions in a quarter, driven by bill payments and fund transfers. Significant year-on-year growth reflects increasing adoption of digital financial services.

Pakistan's branchless banking sector has achieved a significant milestone with over 1 billion transactions recorded in a single quarter, marking a historic first. Data released by the State Bank of Pakistan (SBP) reveals that bill payments and mobile top-ups accounted for 22% of these transactions, while an impressive 43% were attributed to fund transfers.

During the quarter ending on December 31, 2023, banks and Microfinance Banks in Pakistan processed a total of 1,088.3 million branchless banking transactions valued at over Rs5 billion. This represents a notable year-on-year growth of 12% in volume and 12.5% in value. Mobile Wallet transfers emerged as the second-highest in transaction value, amounting to Rs965 billion, followed by transfers from Mobile Wallets to customers' banking accounts totaling Rs756 billion.

The average transaction size during this period stood at Rs4,646, reflecting an increase from the previous year. The State Bank reported a 12% year-on-year rise in average daily transactions, reaching 12 million compared to 10.8 million in the corresponding period last year.

Regionally, Punjab led the way with 71 million branchless banking transactions, followed by Sindh with 23.3 million and Khyber Pakhtunkhwa (KP) with 14.7 million transactions. The total number of branchless banking accounts in the country reached 114.6 million, with a notable gender disparity as males held over 79.5 million accounts compared to 35.1 million female-owned accounts.

In conclusion, Pakistan's branchless banking sector has demonstrated robust growth and widespread adoption, with a diverse range of transactions contributing to its success. The increasing popularity of digital financial services is reshaping the country's financial landscape and paving the way for greater financial inclusion and accessibility.