Saturday, November 16, 2024 07:48 PM

PSX Bullish Momentum Drives KSE-100 Index Near All-Time High

- KSE-100 index rises by nearly 1,000 points.

- Positive investor sentiment fueled by macroeconomic developments.

- IMF bailout deal discussions boost market confidence.

Image Credits: dawn

Image Credits: dawnThe PSX experiences bullish momentum as the KSE-100 index nears an all-time high, driven by positive economic indicators and investor confidence.

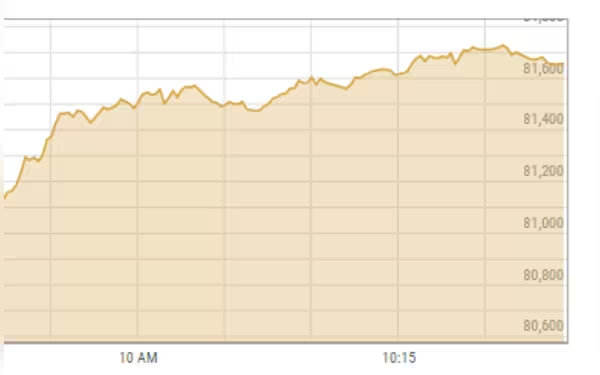

The Pakistan Stock Exchange (PSX) has been experiencing a remarkable surge in activity, with bullish momentum dominating the trading floor. On Thursday, the benchmark KSE-100 index soared by nearly 1,000 points, marking a significant milestone in the market's performance. This upward trend is not just a fleeting moment; it reflects a broader positive sentiment among investors and analysts alike.

As of 11:13 AM, the KSE-100 index had climbed 1,440.81 points, or 1.79 percent, reaching 81,902.14 points from the previous close of 80,461.33 points. By the end of the trading day, the index settled at 81,459.28, up by 997.95 points or 1.24 percent. This impressive gain can be attributed to several key factors that have created a favorable environment for investors.

One of the primary reasons for this bullish trend is the slower-than-expected selling activity due to the FTSE rebalancing, which has compelled local investors to accumulate shares. Mohammed Sohail, the chief executive of Topline Securities, emphasized that falling bond yields are also playing a crucial role in shifting investor focus towards equities. This shift is significant as it indicates a growing confidence in the stock market.

Moreover, the recent decision by the US Federal Reserve to cut interest rates by half a percentage point has had a ripple effect on Asian equities, including those in Pakistan. This rate cut is expected to ease monetary policy, which is particularly beneficial for markets that are sensitive to borrowing costs. Analysts believe that this decision has provided a much-needed boost to investor sentiment.

On the macroeconomic front, there have been several positive developments that have contributed to the upward trajectory of the KSE-100 index. For instance, the current account has recorded a surplus after four months, which is a significant indicator of economic health. Additionally, there are growing hopes surrounding an impending approval from the International Monetary Fund (IMF) regarding Pakistan's bailout deal, which is set to be discussed in an upcoming board meeting.

Yousuf M Farooq, director of research at Chase Securities, pointed out that the climb in the index is closely linked to the Fed's rate cut, with expectations that local rates will follow suit. He also highlighted the positive current account and the likelihood of an IMF deal as contributing factors. Furthermore, inflation numbers for September are anticipated to be below 8 percent, which could further enhance the economic outlook.

Shahab Farooq, director of research at Next Capital Limited, echoed these sentiments, noting that the improving economic outlook, including the current account surplus, has fueled positive investor sentiment. He explained that falling inflation and the US Federal Reserve's rate cut could lead to local monetary easing, which would be beneficial for the market.

In the previous session, the index had already gained over 900 points, driven by improvements in economic indicators and positive news regarding the IMF board meeting scheduled for September 25. This meeting is crucial as it will discuss the $7 billion loan facility for Pakistan, which could provide much-needed financial support.

The current bullish momentum at the PSX reflects a confluence of favorable factors, including international monetary policy changes, positive macroeconomic indicators, and investor optimism regarding the IMF deal. As the market continues to respond to these developments, it is essential for investors to stay informed and consider the potential implications for their investment strategies. The ongoing situation at the PSX serves as a reminder of the dynamic nature of financial markets and the importance of being adaptable in the face of changing economic conditions.