Saturday, November 16, 2024 07:40 PM

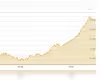

PSX Bullish Trend Continues with 970 Points Gain

- PSX 100-Index rises by 970.20 points.

- Total shares traded decreased to 400 million.

- Sapphire Textile Mills leads with Rs57.88 gain.

Image Credits: nation_pk

Image Credits: nation_pkThe PSX continues its bullish trend, gaining 970.20 points, reflecting strong investor confidence and market dynamics.

On Wednesday, the Pakistan Stock Exchange (PSX) showcased a remarkable bullish trend, with the 100-Index surging by an impressive 970.20 points. This increase represents a positive change of 1.22 percent, bringing the index to a closing value of 80,461.34 points, compared to 79,491.14 points from the previous trading day. Such a significant rise in the stock market reflects the growing investor confidence and optimism in the economic landscape of Pakistan.

During the trading session, a total of 400,195,963 shares were exchanged, which is a decrease from the 536,187,271 shares traded the day before. The total value of shares traded reached Rs15.904 billion, a notable increase from Rs8.911 billion on the last trading day. This fluctuation in trading volume and value indicates a dynamic market environment, where investors are actively seeking opportunities.

In total, 439 companies participated in the stock market transactions. Out of these, 186 companies saw their share prices rise, while 199 experienced declines. Interestingly, the share prices of 54 companies remained unchanged, highlighting a mix of performance across different sectors. The top three trading companies included WorldCall Telecom, which traded 32,229,775 shares at Rs1.36 per share, TRG Pak Limited with 22,086,988 shares at Rs59.90 per share, and Pace (Pak) Limited with 19,649,769 shares at Rs6.94 per share.

Among the companies that recorded significant gains, Sapphire Textile Mills Limited stood out with a remarkable increase of Rs57.88 per share, closing at Rs1,148.77. Following closely was Mari Petroleum Company Limited, which saw its share price rise by Rs41.59, closing at Rs457.49. On the other hand, Unilever Pakistan Foods Limited faced a substantial decline, with its share price dropping by Rs182.77 to close at Rs17,367.23. Sapphire Fibres Limited also experienced a decrease, with a decline of Rs121.42, closing at Rs1,300.10.

The ongoing bullish trend in the PSX is a positive indicator for investors and the economy as a whole. It suggests that market participants are optimistic about future growth and profitability. However, it is essential for investors to remain cautious and informed, as market fluctuations can occur rapidly. Understanding the factors driving these changes can help investors make better decisions and navigate the complexities of the stock market effectively.