Saturday, November 16, 2024 07:23 PM

PSX Bullish Trend Continues with 615 Points Gain

- PSX gains 615.16 points, closing at 82,074.45.

- Foreign investors net purchases reach $87 million.

- Unilever Pakistan Foods sees highest share price increase.

Image Credits: dailytimes_pk

Image Credits: dailytimes_pkThe PSX continues its bullish trend, gaining 615 points, driven by foreign investment and positive economic indicators.

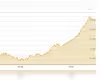

The Pakistan Stock Exchange (PSX) has been on a remarkable upward trajectory, showcasing a bullish trend that has captured the attention of investors and analysts alike. On Friday, the 100-Index of the PSX gained an impressive 615.16 points, marking a positive change of 0.76 percent. This surge brought the index to a closing value of 82,074.45 points, a significant increase from the previous day's close of 81,459.29 points.

During the trading session, a total of 482,373,803 shares were exchanged, surpassing the 459,037,985 shares traded the day before. The total value of shares traded reached Rs 30.188 billion, a notable rise from Rs 18.610 billion on the last trading day. The market saw participation from 453 companies, with 195 recording gains, 196 experiencing losses, and 62 maintaining unchanged share prices.

Among the top trading companies, First Capital Securities led with 31,588,613 shares traded at Rs 2.76 per share. Following closely were Oil and Gas Development, with 29,408,063 shares at Rs 141.29 per share, and Fauji Fertilizer Bin Qasim, which saw 28,625,529 shares traded at Rs 44.36 per share. Notably, Unilever Pakistan Foods Limited experienced the highest increase, with its share price rising by Rs 107.92 to close at Rs 17,616.25. In contrast, Ismail Industries Limited faced a decline, with its share price dropping by Rs 31.79 to close at Rs 1,625.94.

According to a Bloomberg report, the PSX has emerged as one of the best-performing stock markets globally this year. The report attributes this success to an improving economic outlook and a crucial loan agreement with the International Monetary Fund (IMF) reached in July. The index has surged more than 30% this year, bolstered by foreign investors' net purchases of $87 million in local shares, the highest level since 2014. Additionally, the nation’s current account balance has shown improvement, and the central bank has reduced interest rates as inflation eases.

On Thursday, the PSX benchmark KSE-100 index closed near its record high, buoyed by robust foreign inflows and positive macroeconomic indicators. The index gained 1.1%, just shy of the previous record of 81,865.10 points, after reaching a new high earlier in the day. This positive sentiment in the market reflects a broader trend observed in Asian markets, which have been rallying following a significant interest rate cut by the Federal Reserve in the United States.

As the global economic landscape continues to evolve, the PSX's performance serves as a beacon of hope for investors. The combination of foreign investment, improving economic conditions, and strategic monetary policies has created a favorable environment for growth. Investors are encouraged to stay informed and consider the potential opportunities that arise from this bullish trend. The PSX's resilience and upward momentum may very well signal a promising future for the Pakistani economy.