Thursday, July 4, 2024 06:33 PM

State Bank of Pakistan reports significant economic shifts

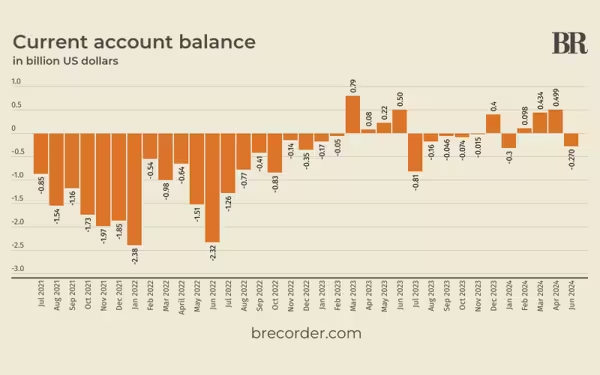

- Current account deficit decreases, reaching $270 million in May 2024

- Efforts to address deficit include high-interest rates and import restrictions

- Exports total $35.81 billion in FY24, with remittances playing a crucial role

Image Credits: brecorder

Image Credits: brecorderThe State Bank of Pakistan reports a significant decrease in the current account deficit, with efforts to stabilize the economy through various measures. Exports, imports, and worker remittances play crucial roles in Pakistan's economic landscape.

Pakistan's economic landscape has seen a notable shift in recent months, as highlighted by the State Bank of Pakistan's latest data. In May 2024, the country recorded a current account deficit of $270 million, a significant change from the previous month's surplus of $499 million. Throughout the fiscal year FY24, the current account deficit stood at $464 million, showcasing a considerable decrease from the previous year's deficit of $3.76 billion.

The efforts to address this deficit have been multifaceted, with factors such as low economic growth, high inflation, increased exports, and remittances playing crucial roles. Additionally, policies like a high-interest rate and import restrictions have contributed to narrowing the current account deficit, reflecting the government's commitment to stabilizing the economy.

In terms of trade, Pakistan's exports of goods and services in May 2024 amounted to $3.69 billion, while imports totaled $5.93 billion. Over the 11-month period of FY24, exports reached $35.81 billion, with imports standing at $57.63 billion. Notably, worker remittances played a significant role, totaling $27.1 billion and marking an 8% increase from the previous year.

The current account balance holds critical importance for Pakistan, a nation heavily reliant on imports. A growing deficit can strain the exchange rate and deplete foreign exchange reserves, underscoring the need for strategic economic management.

Looking ahead, Pakistan is actively engaged in discussions with the International Monetary Fund (IMF) for a new bailout package aimed at bolstering its foreign exchange reserves, which currently stand at $9.13 billion. This partnership with the IMF signifies a proactive approach to addressing economic challenges and ensuring financial stability for the country.