Thursday, July 4, 2024 07:34 PM

State Bank's Monetary Policy Meeting Draws Market Attention

- Experts predict cautious approach despite gap between inflation and policy rate

- Market anticipates rate reduction of 100-300 basis points

- Forecasts indicate potential 600-700 basis points rate decrease by 2025

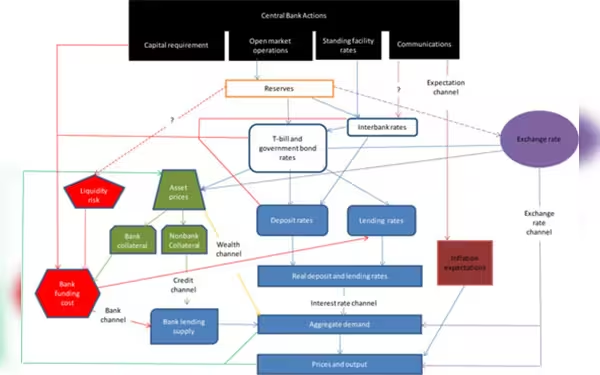

Image Credits: IMF eLibrary

Image Credits: IMF eLibraryThe State Bank's upcoming monetary policy meeting on June 10 is highly anticipated, with expectations of a rate reduction and potential impact on market dynamics.

The State Bank's upcoming monetary policy meeting scheduled for June 10 has captured the attention of various stakeholders. This highly anticipated policy announcement is set to be made independently, without any influence from budgetary measures or discussions with the IMF for additional funding. Despite the significant gap between consumer inflation and the current policy rate, experts are predicting a cautious approach from the State Bank.

A recent survey conducted by Topline Securities revealed that 90% of participants are expecting a rate reduction, with estimates ranging from 100 to 300 basis points. The secondary market is already reacting to the expected interest rate adjustment, as both the Karachi Interbank Offered Rate (Kibor) and government bond yields have started to decline. Market experts believe that uncertainties surrounding budgetary measures could lead the State Bank to maintain a conservative interest rate policy, despite the relatively high real interest rate.

Forecasts and Market Expectations

Forecasts indicate a potential decrease in the policy rate by 600-700 basis points by June 2025, with inflation expected to average around 13% in the upcoming fiscal year. Some experts are predicting an initial reduction of 200 basis points in the policy rate. Market surveys show a strong consensus among participants regarding an imminent rate cut, although opinions vary on the extent of the reduction.

Market Sentiment and Future Outlook

Market sentiment suggests a shift towards a lower policy rate by the end of the year, driven by positive inflation data. Expectations regarding currency depreciation and potential engagement between Pakistan and the IMF are also key topics of discussion. The majority of market observers are predicting a staff-level agreement between Pakistan and the IMF in the near future.

Conclusion

The State Bank's upcoming monetary policy meeting holds significant implications for the financial landscape in Pakistan. With market expectations leaning towards a rate reduction, stakeholders are closely monitoring the developments leading up to the June 10 announcement. The potential impact on interest rates, inflation, and market dynamics underscores the importance of this upcoming decision by the State Bank.