Tuesday, July 2, 2024 03:11 PM

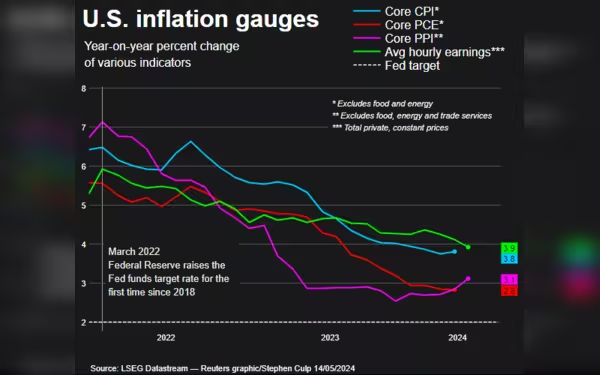

US Producer Inflation Trends Impact Economic Decisions

- May producer inflation up 2.2% annually, down 0.2% monthly

- PPI falls short of market expectations in May

- Core PPI stable monthly, rises annually despite sector impacts

Image Credits: Reuters

Image Credits: ReutersThe latest data on US producer inflation reveals annual growth but monthly fluctuations, impacting economic decisions and highlighting the dynamic nature of inflation trends.

Producer inflation in the United States refers to the measure of price changes for goods and services from the perspective of producers. In May, the latest data showed that producer inflation increased by 2.2% on an annual basis but experienced a 0.2% decrease on a monthly basis. This data is crucial as it provides insights into the overall economic trends and impacts on consumers.

The Producer Price Index (PPI) is a key indicator used to track these price changes. In May, the PPI fell short of market expectations, recording a 2.2% rise compared to the 2.3% increase in April. The monthly PPI drop of 0.2% was also below market predictions, contrasting with the previous month's increase. Notably, prices for final demand goods saw a significant decline in May, driven by a sharp fall in energy prices.

Core PPI, which excludes volatile components, remained unchanged on a monthly basis in May. This stability indicates a slowdown from the previous month's increase. On an annual basis, core PPI showed a consistent rise, reflecting the ongoing inflationary pressures in the economy.

The latest data on producer inflation in the United States highlights the complexities of price movements in the economy. While annual figures show a steady increase, monthly fluctuations and specific sector impacts demonstrate the dynamic nature of inflation. Understanding these trends is essential for businesses, policymakers, and consumers to make informed decisions in a changing economic landscape.