Saturday, November 16, 2024 03:16 PM

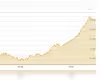

US S&P 500 Index Hits Record High After Fed Rate Cut

- S&P 500 reaches record high post Fed's rate cut.

- Lower interest rates boost consumer spending and investment.

- Major banks lower prime rates, enhancing loan affordability.

Image Credits: tribune.com.pk

Image Credits: tribune.com.pkThe S&P 500 index reaches a record high following the Federal Reserve's recent rate cut, boosting market optimism and consumer spending.

The recent announcement from the Federal Reserve regarding a rate cut has sent ripples of optimism through the financial markets. On Wednesday, the Fed revealed a reduction in interest rates, aligning with the higher end of market expectations. This decision was accompanied by a statement indicating that the central bank has increased confidence in its ability to manage inflation effectively. Such moves are crucial as they directly influence borrowing costs and, consequently, consumer spending and investment.

In the wake of this announcement, the S&P 500 index, a key benchmark for U.S. stocks, reached a record high. This surge can be attributed to the positive sentiment surrounding the financial sector, particularly among major banks. The S&P 500 banks index saw a notable increase of 2.5%, buoyed by significant gains in stocks like Citigroup and Bank of America. These institutions responded to the rate cut by lowering their respective prime rates, making loans more affordable for consumers and businesses alike.

The implications of the Fed's decision are far-reaching. Lower interest rates typically encourage borrowing and spending, which can stimulate economic growth. For everyday Americans, this could mean lower mortgage rates, cheaper car loans, and more accessible credit. As consumers feel more confident in their financial situations, they are likely to increase their spending, further driving economic activity.

However, it is essential to approach this optimism with caution. While the rate cut may provide a temporary boost to the markets, the underlying economic conditions must also be monitored closely. Inflation, while currently under control, can be unpredictable. The Fed's ability to navigate these waters will be critical in maintaining economic stability.

The record high of the S&P 500 index following the Fed's rate cut is a clear indicator of the market's positive response to the central bank's actions. As we move forward, it will be vital for investors and consumers alike to stay informed about economic trends and the potential impacts of monetary policy. The interplay between interest rates and economic growth will continue to shape the financial landscape, making it an essential topic for all to understand.