Friday, October 4, 2024 02:23 PM

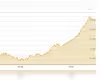

KSE-100 Index Hits Record High with 750 Points Surge

- KSE-100 Index closes at 82,721.76, up 754.76 points.

- Positive investor sentiment driven by declining CPI inflation.

- Government's T-bills buyback program boosts market liquidity.

Image Credits: brecorder

Image Credits: brecorderKSE-100 Index surges over 750 points, closing at record high, reflecting positive investor sentiment and economic indicators.

The Pakistan Stock Exchange (PSX) has recently witnessed a remarkable surge, with the benchmark KSE-100 Index climbing over 750 points to reach a record high. This significant increase reflects a positive sentiment among investors, driven by various encouraging economic indicators. On Thursday, the KSE-100 Index closed at 82,721.76, marking an impressive rise of 754.76 points or 0.92%. This upward trend is a clear indication of growing confidence in the market.

Key sectors such as automobile, cement, commercial banks, fertilizer, oil and gas exploration companies, and oil marketing companies (OMCs) saw substantial buying activity. Notable stocks, including HBL, BAFL, FFC, EFERT, OGDC, PPL, and PSO, all traded positively, contributing to the overall market rally. The improved market sentiment can be attributed to a decline in the Consumer Price Index (CPI) inflation rate, which has led to heightened expectations for a potential policy rate cut. Additionally, the government's initiation of a T-bills buyback program is anticipated to enhance the liquidity position of the capital market.

In the previous trading session on Wednesday, the PSX experienced mixed trading, with the KSE-100 Index fluctuating before ultimately closing at 81,967.01, up by 162.41 points or 0.20%. This volatility highlights the dynamic nature of the market, as investors react to both local and global economic developments.

Globally, markets have also been influenced by various factors. For instance, Japanese shares rallied as the yen weakened following comments from the new prime minister regarding interest rate hikes. Conversely, Hong Kong's market faced a decline after a significant surge fueled by developments in China. Traders worldwide remain cautious, particularly in light of geopolitical tensions, such as Israel's response to Iran's missile attack, which has raised concerns about potential regional conflicts and has driven oil prices higher.

Back in Pakistan, the rupee experienced a slight decline against the US dollar, depreciating by 0.03% in the inter-bank market, closing at 277.74. Despite this, the overall trading volume on the all-share index decreased to 319.88 million shares from 360.99 million shares on Wednesday. However, the value of shares traded increased to Rs16.41 billion, up from Rs15.39 billion in the previous session. WorldCall Telecom emerged as the volume leader with 23.24 million shares traded, followed closely by Fauji Cement and Fauji Fert Bin.

In total, shares of 448 companies were traded on Thursday, with 207 companies seeing an increase in their share prices, while 185 recorded a decline, and 56 remained unchanged. This mixed performance underscores the diverse reactions of investors to the current market conditions.

The recent surge in the KSE-100 Index is a positive sign for the Pakistani economy, reflecting investor confidence and optimism. As the market continues to respond to both local and global economic indicators, it is essential for investors to stay informed and consider the potential implications of these developments. The interplay of various factors, including inflation rates, government policies, and international events, will undoubtedly shape the future trajectory of the PSX. For those looking to invest, understanding these dynamics will be crucial in navigating the ever-changing landscape of the stock market.