Saturday, November 16, 2024 05:31 PM

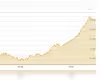

S&P 500 Reaches Record High as Chip Stocks Rally

- S&P 500 hits intraday record high.

- Chip stocks lead market surge ahead of earnings.

- Positive bank earnings boost investor confidence.

Image Credits: tribune.com.pk

Image Credits: tribune.com.pkS&P 500 hits an intraday record as chip stocks surge, driven by positive bank earnings and anticipation of upcoming economic data.

The S&P 500 index has recently achieved an impressive milestone, hitting an intraday record as chip stocks surged ahead of crucial earnings reports and economic data. This surge in the stock market is particularly noteworthy as it follows a strong close on Friday, where the index notched a record high. The excitement in the market can largely be attributed to the positive performance of major banks, which kicked off the third-quarter corporate earnings season with encouraging results.

Chip stocks, which are essential components in various technology products, have been at the forefront of this rally. Investors are keenly watching these stocks, as they play a significant role in the overall performance of the tech sector. The optimism surrounding bank earnings has sparked hopes that solid results from other sectors, including technology, could help maintain the momentum of the stock market's strong performance in 2024.

As the earnings season unfolds, analysts and investors alike are eager to see how companies will report their financial results. A positive trend in earnings could further bolster investor confidence, leading to more gains in the stock market. The anticipation of economic data also adds to the excitement, as it can provide insights into the overall health of the economy and influence market trends.

The recent surge in the S&P 500, driven by chip stocks and positive bank earnings, highlights the interconnectedness of various sectors within the economy. As we move forward, it will be crucial for investors to stay informed about upcoming earnings reports and economic indicators. This knowledge will not only help in making informed investment decisions but also in understanding the broader economic landscape. The current market dynamics serve as a reminder of the importance of staying engaged and informed in the ever-evolving world of finance.