Thursday, November 7, 2024 10:12 AM

ROSHI Report Highlights Future Trends in Digital Lending for 2025

- AI-powered lending models enhance credit risk assessment.

- Global peer-to-peer lending market projected to exceed $705 billion.

- Decentralised Finance (DeFi) market expected to grow significantly.

Image Credits: prnewswire_apac

Image Credits: prnewswire_apacROSHI's report reveals key trends in digital lending, including AI advancements and the rise of DeFi, shaping the future of finance.

In recent years, the world of finance has witnessed a remarkable transformation, particularly in the realm of digital lending. As technology continues to evolve, it is reshaping how individuals and businesses access funds. A new report from Singapore-based fintech company ROSHI sheds light on the future of digital lending, focusing on global trends that are expected to emerge by 2025 and beyond.

The report highlights the significant growth projections across various sectors of digital lending. One of the most notable advancements is the rise of AI-powered lending models. These innovative systems are enhancing credit risk assessment, which could lead to an improvement in performance by 10-15% compared to traditional lending models. This means that lenders can make better decisions, and borrowers may find it easier to secure loans.

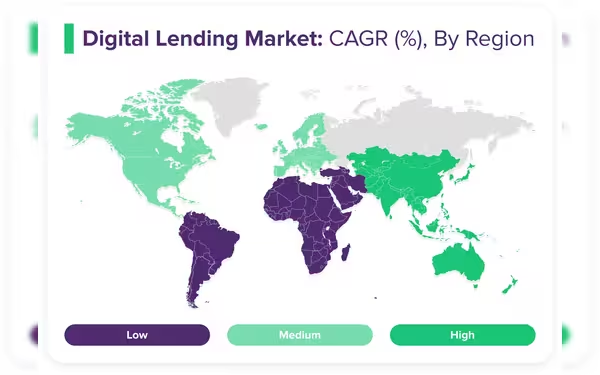

Moreover, the global peer-to-peer lending market is on the brink of substantial expansion. Projections suggest that it will surpass a staggering US$705.81 billion by 2030, growing at a compound annual growth rate (CAGR) of 26.7% from 2022 to 2030. This growth indicates a shift towards more accessible and flexible lending options for consumers.

Another significant trend highlighted in the report is the emergence of Decentralised Finance (DeFi). Valued at USD 13.61 billion in 2022, the DeFi market is expected to expand at an impressive CAGR of 46.0% from 2023 to 2030. This trend reflects a growing interest in alternative financial systems that operate without traditional banks.

The report also emphasizes the increasing influence of open banking. By January 2024, it is anticipated that 13% of digitally active consumers in key European markets will be utilizing open banking services. This shift allows consumers to have more control over their financial data and access a wider range of lending options.

Overall, the digital lending platforms market is poised for significant growth, with projections indicating it will reach a valuation of USD 795.34 billion by 2029, growing at a CAGR of 11.90%. This growth presents exciting opportunities for both lenders and borrowers alike.

Amir Nada, the Founder and CEO of ROSHI, stated, "Our analysis reveals that the lending landscape is undergoing a profound transformation driven by AI, blockchain, and open banking technologies. While these advancements offer unprecedented opportunities for both lenders and borrowers, they also present new challenges in terms of regulation and data security." This statement underscores the importance of balancing innovation with the need for robust regulatory frameworks to protect consumers.

The report further explores the rise of green loans, which are designed to support environmentally friendly projects, and the impact of personalization on lending practices. As the industry evolves, it faces regulatory challenges that must be addressed to ensure a safe and fair lending environment.

The insights provided by ROSHI's comprehensive report serve as a valuable resource for financial institutions, policymakers, and consumers. As digital lending continues to grow and evolve, it is crucial for all stakeholders to stay informed and adapt to the changing landscape. The future of lending is not just about technology; it is about creating a more inclusive and accessible financial system for everyone.