Thursday, July 4, 2024 06:20 PM

Federal Reserve Tightening Policy Amid Global Market Trends

- Wall Street shares retreat due to rising Treasury yields and global market influences

- Bank of England and Swiss National Bank decisions impact market sentiment

- US stock indices show mixed results, fueled by excitement in artificial intelligence sector

Image Credits: channelnewsasia

Image Credits: channelnewsasiaThe Federal Reserve tightens policy amidst global market trends, impacting stock indices and currencies.

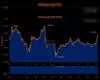

Wall Street shares pulled back from recent record highs on Thursday, influenced by rising Treasury yields and global market trends. The dollar also strengthened against other currencies, nearing levels that had previously prompted intervention by Tokyo. While the Dow Jones Industrial Average held onto gains, the S&P 500 and Nasdaq hit intraday highs before reversing course. Economic data pointing to a slowdown in the labor market suggested that the Federal Reserve's tightening policy is making progress towards its objectives.

Influence of Global Central Banks on Market Sentiment

The Bank of England's decision to refrain from easing measures ahead of the UK general election, along with the Swiss National Bank's interest rate cut, impacted market sentiment. This allowed the Federal Reserve room to adjust its own rates at a suitable time. Despite indications of a slightly weakening economy, expectations for a rate cut in September have slightly decreased.

Market Performance and Sector Highlights

US stock indices closed with mixed results, with the Dow rising while the S&P 500 and Nasdaq declined. The market rally has been fueled by excitement surrounding artificial intelligence, particularly in companies like Nvidia. European shares saw gains, supported by the tech and real estate sectors, as well as Swiss equities following changes in monetary policy by the central bank.

Global Market Overview

Global stock indices reached record highs, with some minor pullbacks. US Treasury yields increased ahead of an upcoming auction of Treasury notes. The dollar strengthened against major currencies, while commodities such as crude oil and gold experienced price hikes. Cryptocurrencies like bitcoin and Ethereum displayed mixed movements.

Conclusion

The fluctuating market trends and global economic developments have led to a mixed performance in stock indices and currency markets. Investors are closely monitoring central bank actions and economic indicators for insights into future market movements. As uncertainties persist, staying informed and diversifying investments remain crucial strategies for navigating the dynamic financial landscape.