Thursday, July 4, 2024 06:15 PM

Federal Reserve Predicts Decline in US Dollar Value

- US Dollar facing downward trend due to economic factors

- Central banks diversifying away from USD for international financing

- Projected decline in USD value to impact global financial markets

Image Credits: Reuters

Image Credits: ReutersRecent research report highlights factors leading to a projected decline in the US Dollar value, impacting global financial markets and prompting central banks to diversify away from USD for international financing.

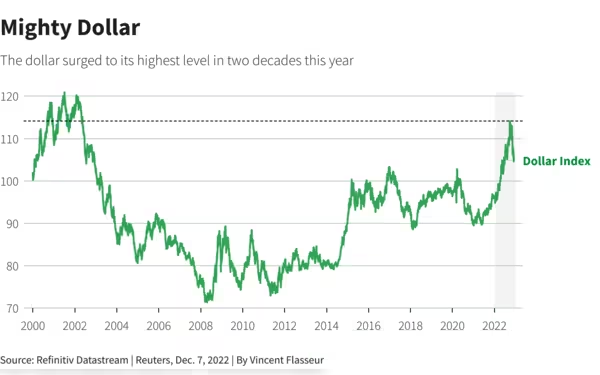

The US Dollar is expected to face a downward trend in the coming years due to various economic factors, as highlighted in a recent research report. The report points out that the combination of fiscal and current account deficits, along with an expansionary monetary policy and restrictive fiscal policy, will likely put pressure on the value of the US Dollar. This trend aligns with market estimations, forecasting a decline in the US Dollar Index against major currencies by 2026-28. Central banks and policymakers are looking to diversify away from the US Dollar for international financing, as the risks associated with holding assets in USD increase. The report also mentions that the share of US Dollar held by central banks as foreign reserves is at its lowest level in nearly three decades.

Despite a strong labor market and high nonfarm payroll numbers, underlying issues such as pandemic-related deficits and aggressive interest rate policies are expected to prompt the Federal Reserve to implement interest rate cuts and monetary easing in the near future. The report suggests that a depreciating USD could benefit emerging economies, as global liquidity and relaxed financial conditions during a weakening USD could be advantageous for financing in these markets. Additionally, the shift away from the dollar towards alternative systems could lead to higher prices for gold and bulk commodities, as countries aim to become self-reliant and competitive in the green transformation amidst disrupted global supply chains.

Overall, the projected decline in the US Dollar value is expected to have significant implications on global financial markets, with investors likely to adjust their portfolios by favoring longer-term bonds and higher-yield investments over traditional assets like bank deposits or T-bills.