Thursday, July 4, 2024 07:41 PM

FedEx and Rivian Drive Market Surge

- FedEx's strong earnings lead to stock surge

- Nasdaq sees slight increase, Dow and S&P decline

- Rivian Automotive surges 31% after Volkswagen partnership

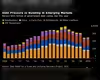

Image Credits: brecorder

Image Credits: brecorderToday's Wall Street mixed start driven by FedEx's strong earnings, caution over high valuations. Rivian Automotive surges 31% after Volkswagen partnership. Stay informed for future investment decisions.

Wall Street saw a mixed start today as FedEx reported strong earnings, leading to a surge in its stock price. However, investors are exercising caution due to concerns over high equity valuations following a robust performance in the first half of 2024.

After the initial trading period, the Dow Jones Industrial Average declined by 0.4% to 38,952.55, while the S&P 500 dipped by 0.1% to 5,461.45. In contrast, the Nasdaq Composite Index managed a slight increase of 0.1% to reach 17,740.21. Rivian Automotive experienced a remarkable 31% surge after announcing a partnership with Volkswagen, involving a substantial investment of up to $5 billion. Additionally, Whirlpool's stock price jumped by approximately 15% following reports of a potential takeover bid by German engineering firm Robert Bosch.

Looking ahead, upcoming economic data releases, including the third estimate for first-quarter GDP and PCE prices, are eagerly anticipated by investors. These reports will provide crucial insights into the economic landscape and potential market trends.

Today's market movements reflect a blend of positive corporate performances and investor wariness regarding high stock valuations. The partnership announcements and potential takeover bids have injected excitement into the market, while economic data releases remain pivotal for shaping future investment decisions. Investors are advised to stay informed and monitor developments closely to navigate the evolving financial landscape effectively.