Sunday, July 7, 2024 11:02 AM

HDFC Bank Leads Market Surge with 7% Growth

- Indian shares set to open higher, extending record-breaking streak

- Financial sectors drive market surge, with HDFC Bank's impressive growth

- RBI forecasts 7% economic expansion, fueled by rural demand and easing inflation

Image Credits: ET BFSI

Image Credits: ET BFSIIndian shares poised for a positive start as market surges on strong corporate earnings and optimistic economic projections. HDFC Bank leads the way with impressive growth.

Indian shares are poised to open higher on Monday, aiming to extend their record-breaking streak as the corporate earnings season looms. The GIFT Nifty is currently trading at 22,656.5, indicating a positive opening for the NSE Nifty 50 compared to its previous close of 22,513.70. Last week, both the Nifty and Sensex marked their third consecutive week of gains, with the Sensex achieving a new closing high while the Nifty narrowly missed its own record.

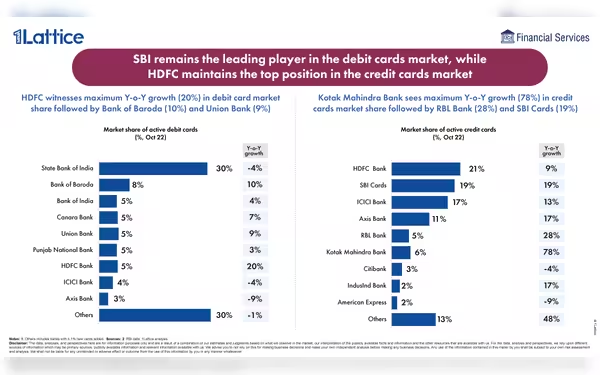

Financial sectors spearheaded the market surge, with HDFC Bank's impressive 7% growth following a robust performance in deposit growth for the March quarter. On the other hand, consumer companies delivered a mixed bag of sales updates, although the expectation of reduced inflation bodes well for upcoming financial results. The Reserve Bank of India remains optimistic, forecasting a 7% expansion in the economy for the fiscal year, driven by rural demand, improved employment prospects, and easing inflationary pressures.

As the earnings season kicks off this week, market experts anticipate steady growth. However, Asian markets exhibited a subdued tone due to the impact of a strong US jobs report, which has tempered expectations of a Federal Reserve rate cut in June. The likelihood of a pause in rate cuts has increased to 52% from around 40% a week ago, as per the CMEGroup's FedWatch tool. Wipro is under the spotlight following the resignation of Thierry Delaporte as CEO over the weekend.

In conclusion, the Indian stock market is gearing up for a positive start amidst record highs and anticipation surrounding the earnings season. While global factors may introduce some uncertainty, the domestic outlook remains optimistic, supported by strong performances in key sectors and favorable economic projections.