Thursday, July 4, 2024 07:38 PM

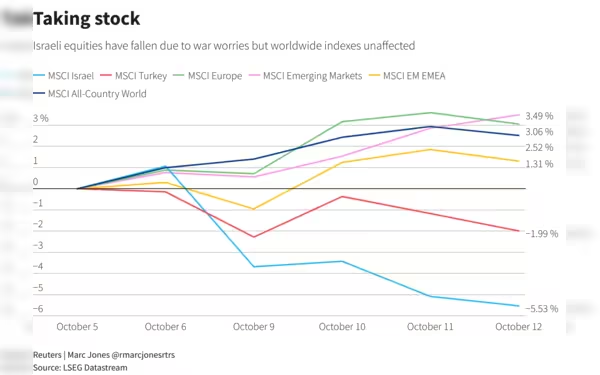

Global Markets React to Middle East Tensions

- Oil prices surge and equities plummet due to Middle East crisis

- US economy strength raises fears of Fed interest rate adjustments

- Geopolitical tensions and monetary policy uncertainty impact global markets

Image Credits: Reuters

Image Credits: ReutersGlobal markets react as oil prices surge and equities plummet amid Middle East tensions. US economy strength raises fears of Federal Reserve interest rate adjustments, impacting global markets and stability.

Oil prices surged and global equities plummeted on Friday following reports of explosions in Iran and Syria, heightening concerns of a potential escalation in the Middle East crisis. The tensions were exacerbated by recent data indicating a robust US economy, leading to fears that the Federal Reserve may delay interest rate cuts or even consider raising them.

The turmoil was triggered by a missile attack on Israel by Tehran, prompting reports of explosions near Isfahan airport and an army airbase. While initial fears of a regional conflict caused crude prices to spike and stocks to tumble, Iran later downplayed the situation, asserting the safety of its nuclear facilities.

Despite the reassurances, markets remained jittery, with Asian equities experiencing significant losses. Major cities like Tokyo, Taipei, Hong Kong, Sydney, and Shanghai saw sharp declines, while European markets in London, Paris, and Frankfurt also fell.

The uncertainty surrounding the Fed's monetary policy added to the negative sentiment, with officials signaling a reluctance to implement rate cuts this year. Atlanta Fed President Raphael Bostic emphasized that inflation levels were elevated, suggesting a delay in any potential rate adjustments.

As investors grapple with the geopolitical tensions and monetary policy outlook, the situation remains fluid, with the potential for far-reaching consequences on global markets and Middle East stability.