Thursday, July 4, 2024 07:34 PM

Modi's Election Victory Impacting Global Stock Markets

- Stock markets face downturn on worries about US economy's future challenges

- OPEC+ alliance decision to ease production cuts adds to concerns about global demand

- Investors cautious as Federal Reserve speculations hint at delayed interest rate cuts

Image Credits: urdupoint

Image Credits: urdupointGlobal stock markets face downturn amid concerns over US economy, interest rate cuts, and impact of Modi's election victory on Indian stocks.

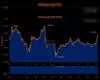

On Tuesday, stock markets faced a downturn as worries about the US economy's future challenges weighed on investors' minds. Despite recent weak data hinting at potential interest rate cuts by the Federal Reserve, uncertainties in the market led to a drop in oil prices, impacting global energy companies. The decision by the OPEC+ alliance to ease production cuts starting in October added to concerns about weakening global demand.

Investors have been anxious due to speculations that the Federal Reserve might delay interest rate cuts until 2025. This caution is driven by persistent inflation levels above the target and policymakers' reluctance to act prematurely, emphasizing the need for more evidence of inflation control. The Institute for Supply Management's manufacturing index for May indicated a second consecutive month of contraction in US activity, highlighting challenges like high interest rates and subdued consumer spending.

Market analysts observed that the manufacturing data confirmed ongoing economic trends, such as slowing growth, decelerating inflation, and a tight labor market. This has raised expectations of a potential rate cut later in the year, as seen in interest rate futures. Despite initial interpretations of soft economic data as positive for rate cuts, recent developments have sparked concerns about the economic outlook.

Traders are eagerly awaiting the release of US non-farm payroll figures on Friday to gain insights into the labor market of the world's largest economy. The selling pressure on Wall Street extended to Asian and European markets, leading to further declines in US indexes. In Asia, Indian stocks plummeted amid indications that Prime Minister Narendra Modi's election victory might not be as significant as expected.

The Sensex in Mumbai dropped over seven percent as Modi's Bharatiya Janata Party appeared likely to win the national elections without the anticipated landslide victory. The market had surged more than three percent the previous day on hopes that a strong majority would enable Modi to implement measures to boost the economy.

- Hong Kong - Hang Seng Index: Up 0.2 percent at 18,444.11 (close)

- West Texas Intermediate: Down 1.5 percent at $73.09 per barrel

- Brent North Sea Crude: Down 1.5 percent at $77.22 per barrel

The recent fluctuations in stock markets reflect the delicate balance between economic indicators and investor sentiment. As uncertainties persist regarding interest rate cuts and global economic conditions, it is crucial for investors to stay informed and monitor key market developments closely to make well-informed decisions.