Thursday, July 4, 2024 05:47 PM

Government Contemplates Scrapping Bank Profit Tax

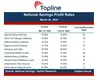

- Potential removal of 15% tax on bank profits to benefit sector by Rs60 billion

- Finance Act 2024 to eliminate tax, but salaried class tax hike remains

- Banking sector criticizes tax on ADR, concerns about borrowing dynamics

Image Credits: tribune_pk

Image Credits: tribune_pkThe government in Pakistan is considering removing an extra income tax on bank profits, potentially benefiting the banking sector by Rs60 billion. While aiming to boost the financial industry, concerns arise about the impact on borrowing dynamics and sustainable advancement amidst ambitious tax collection targets.

The government is contemplating removing an extra income tax of up to 15% on bank profits derived from lending to the finance ministry. This potential change could benefit the banking sector by approximately Rs60 billion. Last year, the banking industry amassed profits totaling Rs960 billion. The Finance Minister is anticipated to introduce the Finance Act 2024 in the National Assembly for approval, which encompasses the elimination of this tax.

Conversely, while the government is poised to offer respite to banks, it is not rescinding the substantial tax hike for the salaried class. Initially, the Federal Board of Revenue proposed tightening the tax regulations for banks to curb tax evasion. However, the government is now contemplating scrapping the tax altogether.

The banking sector has decried the tax on Advances-to-Deposit Ratio (ADR) as unjust, contending that it fails to incentivize the government to curtail borrowing. The Pakistan Banks Association has expressed apprehensions regarding the repercussions of this tax measure on the banking sector's capacity to sustainably augment advances.

Looking ahead, the government's objective is to amass Rs12.97 trillion in taxes for the upcoming fiscal year, representing a formidable 40% growth target to achieve within a year.

The potential elimination of the additional income tax on bank profits by the government could have significant implications for the banking sector in Pakistan. While this move aims to bolster the financial industry, concerns persist regarding the impact on borrowing dynamics and sustainable advancement. As the government strives to meet ambitious tax collection targets, the evolving tax landscape underscores the complexities of balancing fiscal policies to foster economic growth.