Thursday, July 4, 2024 05:59 PM

Pakistan Government Introduces Revised Defence Savings Certificates Profit Rate

- Defence Savings Certificates offer 14.1% profit rate for long-term investors

- Certificates available in denominations from Rs.500 to Rs.1,000,000

- Taxes and Zakat deducted from profits as per State Bank of Pakistan's policy

Image Credits: Business Recorder

Image Credits: Business RecorderThe Defence Savings Certificates scheme in Pakistan offers a competitive 14.1% profit rate for long-term investors, with taxes and Zakat deductions applied. Available in various denominations, these certificates cater to both local and overseas investors seeking secure savings over a 10-year period.

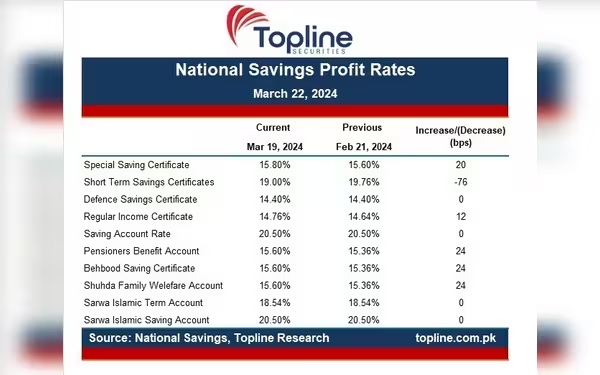

The Government of Pakistan introduced the Defence Savings Certificates (DSCs) scheme in 1966 to meet the financial needs of long-term investors and offer them an opportunity to maximize their savings. Recently, the National Savings or Qaumi Bachat Bank announced a revised profit rate for various investment certificates, effective from March 19, 2024. The profit rate for Defence Savings Certificates has been set at 14.1 percent.

These certificates, available in denominations ranging from Rs.500 to Rs.1,000,000, have a maturity period of 10 years. Both Pakistani nationals and overseas Pakistanis are eligible to purchase these certificates. Following the latest revision, the profit rate remains steady at 14.1%. For every Rs.100,000 invested, the payable amount (principal + profit) is determined accordingly.

It is important to note that taxes and Zakat are deducted from the profits in accordance with the State Bank of Pakistan's policy. Filers are subject to a 15 percent withholding tax, while non-filers face a 30 percent deduction.

In conclusion, the Defence Savings Certificates scheme continues to offer a competitive profit rate, providing investors with a secure long-term savings option. With its attractive returns and accessibility to both local and overseas investors, these certificates remain a popular choice for those looking to grow their wealth steadily over a 10-year period.