Thursday, July 4, 2024 07:06 PM

IMF and SBP drive FDI repatriation recovery

- Repatriation of FDI rebounds in FY24 after significant decline in FY23

- SBP eases restrictions on repatriation, influenced by IMF pressure

- Resurgence in repatriation signals positive development for economy

Image Credits: Business Recorder

Image Credits: Business RecorderThe repatriation of dividends and profits on net foreign direct investment has shown signs of recovery in FY24, driven by easing restrictions from the State Bank of Pakistan and pressure from the IMF. This turnaround reflects improved conditions for foreign investors and highlights the interconnected nature of global financial dynamics and national economic policies.

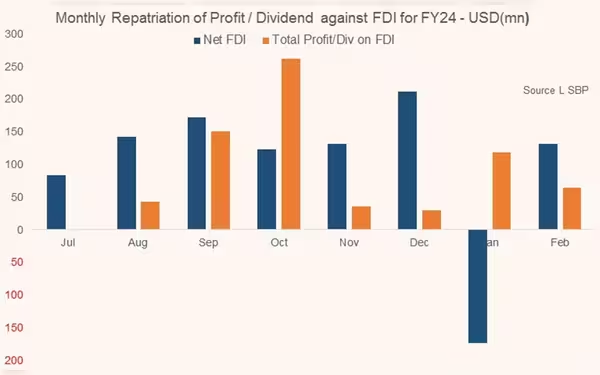

The repatriation of dividends and profits on net foreign direct investment, which had plummeted to negligible levels in FY23, has shown signs of recovery. In FY23, total repatriation of FDI decreased by 82 percent year-on-year, marking the lowest level in 15 years. This decline continued into early FY24, reflecting the challenges faced by multinational companies. However, in the first 7 months of FY24, there has been a significant turnaround, with repatriation growing by 3.7 times to $703 million compared to $189 million in the same period of FY23.

The decline in repatriation in FY23 was attributed to various factors, including restrictions on outward remittance of profits on foreign investment imposed by authorities to control dollar outflows. The fragile foreign exchange reserve position and economic conditions also played a role in companies' reduced profitability and dividend payouts. Sectors such as power, telecom, transport, energy, and food and beverages were particularly affected by the decline in repatriation.

The State Bank of Pakistan (SBP) recently eased restrictions on repatriation of dividends and profits, partly due to pressure from the IMF. The IMF has reportedly linked complete repatriation to the financing package for the country, emphasizing the importance of addressing the challenges faced by multinational companies in repatriating their earnings.

In conclusion, the resurgence in repatriation of dividends and profits on FDI in FY24 signals a positive development for the economy, reflecting improved conditions for foreign investors. The easing of restrictions by the SBP and the influence of the IMF have played a crucial role in facilitating this turnaround, highlighting the interconnected nature of global financial dynamics and national economic policies.