Thursday, July 4, 2024 06:15 PM

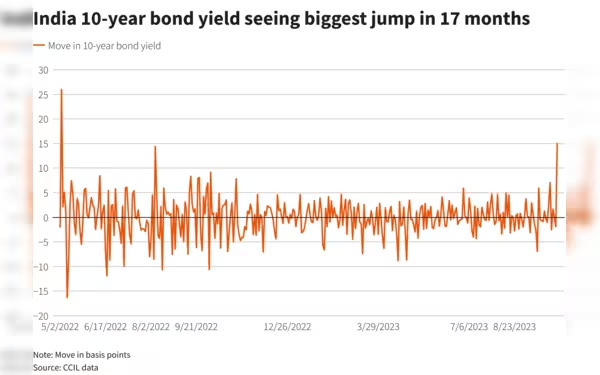

Indian bond yields surge due to global uncertainties

- Indian 10-year bond yield hits 7.1890%, highest since January 25

- Geopolitical tensions and oil price fluctuations drive bond yield movement

- Expectations of delayed interest rate cuts in India and the US impact yields

Image Credits: Reuters

Image Credits: ReutersIndian government bond yields rise to three-month highs due to geopolitical tensions, oil price fluctuations, and expectations of delayed interest rate cuts in India and the US.

India's benchmark government bond yields have surged to nearly three-month highs due to heightened geopolitical tensions and expectations that the Federal Reserve will delay cutting interest rates. The yield on the Indian 10-year bond reached 7.1890%, the highest level since January 25. Concerns over escalating conflicts in the Middle East have led market analysts to predict further increases, with some suggesting the yield may test 7.20% and even 7.25%.

Oil prices have also played a role in the bond yield movement, rising following Israel's military chief's statement regarding potential responses to Iran's recent attacks. Despite initial fears, the impact of Iran's actions on oil supply proved less severe than anticipated, leading to a slight easing of concerns. However, higher oil prices could still impact India's retail inflation, which saw a decrease in March.

Economists believe that an interest rate cut in India is unlikely in the near future, especially after the US 10-year Treasury yield hit five-month highs. Stronger-than-expected retail sales data in the US has raised doubts about the Fed's plans to cut rates this year. The current expectation is for the first rate cut to occur in September, with markets pricing in a total of 44 basis points of cuts by the end of December.

Two Indian states are planning to raise a combined total of 19 billion rupees through bond sales, indicating continued activity in the local bond market despite the global uncertainties.

The combination of geopolitical tensions, oil price fluctuations, and uncertainty surrounding interest rate cuts has led to a significant rise in Indian bond yields. Investors are closely monitoring global developments to gauge the future direction of bond markets and the broader economy.