Tuesday, July 2, 2024 04:39 PM

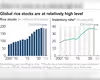

Opec Plus extends production cuts amid oil market volatility

- Brent oil prices hit lowest since February 2024, but recovery expected

- Opec Plus extends production cuts to stabilize market amidst subdued demand

- Saudi Arabia and Russia ready to counter potential production hikes

Image Credits: brecorder

Image Credits: brecorderRecent decline in Brent oil prices prompts Opec Plus to extend production cuts, emphasizing market stability amidst subdued demand. Saudi Arabia and Russia remain vigilant in managing oil prices.

Brent oil prices have recently seen a significant decline, reaching their lowest point since February 2024. However, signs of a recovery are emerging, with expectations of prices rebounding to the mid-80s. The recent surprising decision by the Opec Plus alliance to prolong production cuts until the end of 2025 reflects concerns about ongoing subdued demand and the alliance's dedication to market stability.

The move to extend cuts by over 3.6 million barrels per day indicates an acknowledgment of the uncertain demand outlook in the near future. It also showcases the confidence that member countries, especially Saudi Arabia and Russia, have in the alliance's leadership. The possibility of reversing voluntary production cuts has led to negative sentiments in the market, prompting Opec to stress its commitment to maintaining favorable prices.

Market responses have led Opec to suggest a potential delay in rolling back the voluntary cuts if prices continue to face downward pressure. The Saudi Energy Minister has cautioned about potential production adjustments to prevent a significant price drop. These developments indicate that bearish trends may find it challenging to gain traction from current levels.

Global demand dynamics, influenced by lower-than-expected imports by China, have moderated demand growth. Nevertheless, expectations of increased travel activity in the latter half of 2024 could boost overall demand. Positive reactions in equity markets to anticipated European interest rate cuts and expectations regarding the US Federal Reserve's policy decisions are also bolstering demand projections for the latter part of the year.

The recent decision by Opec Plus underscores the alliance's unchanged perspective on global demand and its readiness to adapt production levels as necessary. Saudi Arabia and Russia are prepared to counter any potential production hikes by other members, reaffirming their commitment to price stability. Saudi Arabia's consistent efforts to manage oil prices within a specific range, typically above $80 per barrel, are anticipated to persist.

The oil market is navigating through a period of volatility, with Brent oil prices experiencing fluctuations and Opec Plus extending production cuts to address subdued demand. As global dynamics evolve, the alliance remains vigilant in its efforts to stabilize prices and ensure market equilibrium. The coming months hold the promise of demand resurgence, driven by factors such as increased travel and supportive economic policies, offering hope for a more balanced oil market in the near future.