Thursday, July 4, 2024 05:57 PM

Pakistan Stock Exchange faces decline after crossing 71,000 milestone

- Index started positively but settled in the red at 70,483.66

- Pakistan in talks with IMF for new loan agreement

- Global market trends show Asian stocks declining and oil prices rising

Image Credits: The News Tribe

Image Credits: The News TribeThe Pakistan Stock Exchange's KSE-100 Index closed lower after crossing 71,000, with market movements influenced by economic cooperation talks and global trends.

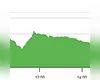

The Pakistan Stock Exchange's benchmark KSE-100 Index closed the trading session on Tuesday in the red, failing to sustain the 71,000 level crossed in the first half of the day. The index started positively, reaching a milestone by crossing 71,000 for the first time. However, selling pressure in the latter half of the session led to a decline, with the index settling at 70,483.66, down by 0.09%.

Market Movements and Key Developments

Early-session buying was observed in index-heavy sectors such as commercial banks, oil and gas exploration companies, OMCs, and power generation. Notable stocks like OGDC, PPL, SNGPL, and HBL traded in the green. In a significant development, Pakistan initiated discussions with the IMF for a new multi-billion dollar loan agreement to support economic reforms. Additionally, a high-level Saudi delegation visited Pakistan to focus on economic cooperation and ongoing projects under the Special Investment Facilitation Council.

Global Market Trends

Internationally, Asian stocks declined, and oil prices rose amid escalating tensions in the Middle East. Wall Street experienced a downturn following strong US retail sales data, impacting hopes for interest rate cuts. Chinese economic figures showed mixed results, with growth surpassing expectations but retail sales and industrial production falling short.

Foreign Exchange and Trading Volume

The Pakistani rupee depreciated against the US dollar, settling at 278.29 in the inter-bank market. Trading volume on the all-share index slightly decreased, with shares of 369 companies being traded. Of these, 175 saw an increase, 168 recorded a fall, and 26 remained unchanged.

Conclusion

The market's fluctuation reflects both domestic and international factors influencing investor sentiment. Continued developments in economic cooperation and geopolitical tensions are likely to impact future market movements.