Thursday, July 4, 2024 06:36 PM

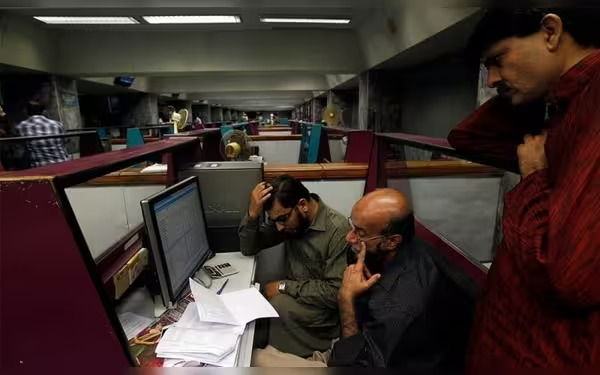

Pakistan Stock Exchange faces bearish sentiment amid global market trends

- KSE-100 Index drops by 0.63%, key sectors experience selling pressure

- Investors react to unchanged policy rate, IMF loan tranche release

- Headline inflation decreases to 17.3%, trade deficit narrows by 18%

Image Credits: brecorder

Image Credits: brecorderThe Pakistan Stock Exchange faced bearish sentiment with the KSE-100 Index dropping by 0.63%. Investors reacted to unchanged policy rates and IMF loan tranches, while domestic economic indicators showed improvements.

The Pakistan Stock Exchange (PSX) witnessed bearish sentiment on Thursday as the benchmark KSE-100 Index dropped by nearly 450 points, closing at 70,657.64, marking a 0.63% decrease. Key sectors such as automobile assemblers, chemical, commercial banks, fertiliser, and oil and gas exploration companies experienced selling pressure, leading to a decline in index-heavy stocks. The market analysts attributed this downturn to investors' focus on the unchanged policy rate set by the Monetary Policy Committee (MPC) despite the International Monetary Fund's release of a $1.1-billion loan tranche.

Globally, Asian stocks and US futures saw a rise following the Federal Reserve's reassurance on interest rate hikes. However, the yen experienced volatility after suspected intervention from Japan. In Pakistan, the headline inflation for April stood at 17.3% year-on-year, showing a decrease from the previous month. The trade deficit also narrowed by 18% to $19.5 billion during July-April, driven by reduced imports and increased exports.

On the currency front, the Pakistani rupee remained stable against the US dollar, closing at 278.3 in the inter-bank market. Trading volume and share value on the PSX decreased, with K-Electric Ltd, WorldCall Telecom, and B.O.Punjab emerging as the top traded companies. Out of 365 companies, 103 saw an increase, 234 recorded a fall, while 28 remained unchanged.

In conclusion, the PSX faced a challenging trading session with significant fluctuations in key sectors and index-heavy stocks. The global market trends, coupled with domestic economic indicators, influenced investor sentiment, leading to a mixed performance on the stock exchange.