Thursday, July 4, 2024 06:38 PM

Pakistan's Current Account Surplus Reaches 13-Month High

- Surge in workers' remittances drives current account surplus to $491 million in April

- Record-high technology exports and four-year high FDI inflow support surplus

- Government's proactive measures crucial in reducing current account deficit to $202 million

Image Credits: tribune_pk

Image Credits: tribune_pkPakistan's current account surplus hits a 13-month high of $491 million in April, driven by increased workers' remittances and FDI inflows. Government interventions and economic strategies have effectively reduced the deficit to $202 million, signaling a positive economic trajectory.

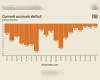

Pakistan's current account surplus in April soared to a 13-month high of $491 million, driven by a surge in workers' remittances from overseas Pakistanis. This positive development has significantly reduced the cumulative current account deficit to a nominal $202 million in the first 10 months of the fiscal year 2023-24. The State Bank of Pakistan's latest report highlighted a surplus in the current account for the third consecutive month in April, supported by record-high technology exports at $310 million and a four-year high foreign direct investment (FDI) inflow of $359 million during the same period.

The revised current account surplus for March 2024 stood at $434 million, down from the initial estimate of $691 million. April's surplus marked a remarkable 266% increase compared to the same month last year, totaling $434 million. This positive trend has led to a substantial decrease in the current account deficit to $202 million in the first 10 months of the fiscal year 2023-24, a significant improvement from the $3.92 billion deficit recorded in the previous year.

The robust inflows of workers' remittances, amounting to $2.81 billion in April, played a pivotal role in maintaining the current account surplus. Despite challenges such as a widening trade and services balance and negative primary income, the current account deficit was effectively narrowed down to $202 million in the first 10 months. The government's proactive measures to regulate imports and enhance workers' remittances have been crucial in achieving this exceptional performance in the current account balance.

The government's economic strategies have effectively steered the economy amidst obstacles like low foreign exchange reserves. The decline in imports below $4.5 billion in April impacted industrial output but contributed to the reduction of the current account deficit. Government interventions were necessary to avert a widened current account deficit and potential risks of default on foreign debt repayments.

Looking ahead, it is anticipated that the full-year current account deficit for FY24 will range between $500-600 million, with strong support from workers' remittances in the final two months. Factors such as robust remittance receipts pre-Eidul Azha and low commodity prices in global markets have been instrumental in Pakistan's ability to maintain a favorable current account balance.

In April, Pakistan witnessed a notable increase in FDI, reaching $359 million, with China emerging as the leading investor. The power sector attracted the highest FDI inflows, signaling positive investor sentiment towards the country.

The recent surge in Pakistan's current account surplus reflects a positive economic trajectory, driven by factors such as increased workers' remittances and foreign direct investment. The government's proactive policies and interventions have played a vital role in maintaining a favorable current account balance amidst challenges. Continued focus on enhancing remittances, controlling imports, and attracting foreign investment will be key to sustaining this positive momentum in Pakistan's economy.