Thursday, July 4, 2024 06:21 PM

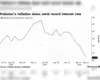

Pakistan's Inflation Forecast: Brokers Predict Sharp Decline

- CPI-based inflation expected to drop to 13-14% in May 2024

- SBP aims to lower inflation to 5-7% by September 2025

- Potential policy adjustments may lead to inflation surge in July

Image Credits: brecorder

Image Credits: brecorderTwo brokerage firms predict a significant drop in Pakistan's CPI-based inflation for May 2024, driven by lower food prices. The State Bank of Pakistan aims to reduce inflation to 5-7% by September 2025, with potential policy adjustments expected to impact inflation in July.

Two brokerage firms have forecasted a significant decrease in CPI-based inflation for May 2024, estimating it to be between 13-14%. This expected decline is primarily due to a high base effect from the previous year and consecutive monthly decreases. The main reason behind this drop is the anticipated lower food inflation.

In April, Pakistan's headline inflation stood at 17.3% year-on-year, showing a decrease from the previous month's 20.7%. However, the focus now shifts towards the inflation outlook from July onwards and its potential impact on monetary policy decisions.

The State Bank of Pakistan (SBP) has stressed the significance of the Federal Budget FY25 announcement in June and its subsequent implementation from July onwards in determining the course of monetary policy. The central bank's objective is to bring inflation down to the target range of 5-7% by September 2025.

Another brokerage house has projected the May inflation rate to be 13.1%, with a monthly decrease estimated at 2.1%. This decrease is mainly attributed to lower food prices and adjustments in the Foreign Currency Account (FCA). Real interest rates are expected to hit a 20-year high at 8.9%, potentially paving the way for a rate cut in the upcoming Monetary Policy Committee meeting.

Both brokerage reports emphasize the unexpected sharp decline in inflation, largely influenced by the decrease in food prices. The upcoming budget announcement in June is anticipated to tackle fiscal challenges and might involve higher levies and taxes to support a longer-term IMF plan.

Analyses indicate that potential policy adjustments, such as increased fuel prices and GST rates, could lead to a notable inflation surge in July. The combined impact of these modifications might result in a substantial monthly inflation increase, with forecasts suggesting a CPI of 15% for the financial year 2024-25.

The projected drop in inflation for May 2024 reflects a complex interplay of various economic factors, with food prices and policy changes playing pivotal roles. As Pakistan navigates through these fluctuations, the upcoming budget announcement and subsequent policy decisions will be crucial in shaping the country's economic landscape. Stay informed to understand how these developments may impact your daily life and financial decisions.