Thursday, July 4, 2024 05:48 PM

Pakistan's State-Owned Enterprises Report Record Losses

- SOEs in Pakistan face Rs905 billion losses in FY 2022-23

- Power sector contributes significantly to overall losses

- Government support strains federal budget with Rs1,021 billion

Image Credits: Dawn

Image Credits: DawnState-owned enterprises in Pakistan have reported a substantial increase in losses, reaching Rs905 billion in the fiscal year 2022-23. The power sector, infrastructure entities, and various SOEs are facing significant financial challenges, highlighting the urgent need for improved corporate governance and strategic measures to enhance economic performance.

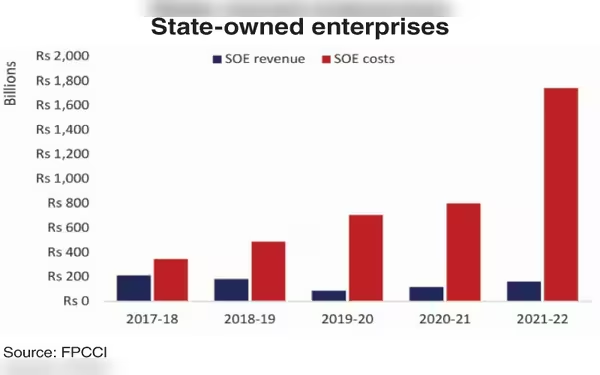

State-owned enterprises in Pakistan have reported a substantial increase in losses, reaching Rs905 billion in the fiscal year 2022-23, marking a 23% rise from the previous year. The Central Monitoring Unit of the Finance Division has highlighted that despite total profits amounting to Rs703 billion, the aggregate net losses stood at Rs202 billion, showing a 25% increase.

The power sector, particularly the DISCO side, continues to encounter challenges with aggregate losses totaling Rs304 billion, despite receiving substantial support of Rs759 billion. The infrastructure sector, including entities like NHAs, has also contributed to the overall loss-making scenario, amounting to Rs413.5 billion. Railways have further added to the losses with Rs48.5 billion.

Various state-owned entities, such as Pakistan International Airlines Corporation, Pakistan Steel Mills Corporation, Pakistan Telecommunication Company Limited, Pakistan Post Office, and Pakistan Broadcasting Corporation, have reported significant losses. Entities within the power sector, like Quetta Electric Supply Company Limited, Peshawar Electric Supply Company Limited, and Lahore Electric Supply Company Limited, are facing substantial losses.

Over the past decade, these entities have accumulated losses totaling Rs5,595 billion, with the government providing support of Rs1,021 billion in various forms to sustain these SOEs. However, this support has strained the federal budget significantly, representing more than 10% of its receipts.

The SOE sector faces risks such as working capital lock-up, operational inefficiencies in the power sector, and a circular debt exceeding Rs4 trillion. Guarantees provided and the debt stock have reached alarming levels, posing systemic and unsystemic risks to the sector.

Despite the challenges, these SOEs have contributed significantly to the national exchequer through taxes, non-tax revenues, and dividends. On the positive side, 15 PESs recorded profits totaling Rs703.3 billion during the fiscal year 2022-23.

There is a pressing need for improved corporate governance within SOEs, emphasizing the appointment of independent and qualified directors, robust monitoring criteria, and dynamic business models. The government is taking steps to assess and value all SOEs, establish a regulatory framework for privatization, engage stakeholders, develop a risk management strategy, and implement a monitoring system to enhance economic performance.

The challenges faced by state-owned enterprises in Pakistan highlight the importance of implementing effective governance and strategic measures to address financial losses and operational inefficiencies. By enhancing transparency, accountability, and efficiency within these entities, Pakistan can work towards a more sustainable and economically viable future.