Saturday, November 16, 2024 05:44 PM

PSX Bears Down as Market Loses 366 Points

- PSX 100-Index declines by 366.86 points.

- Trading volume drops to 369 million shares.

- Global markets rally despite PSX challenges.

Image Credits: dailytimes_pk

Image Credits: dailytimes_pkThe PSX continues its bearish trend, losing 366 points as trading volume declines amid global market rallies.

The Pakistan Stock Exchange (PSX) has been experiencing a bearish trend, which means that the market is generally declining. On Tuesday, the 100-Index of the PSX lost 366.86 points, marking a negative change of 0.45 percent. This brought the index down to 81,483.64 points, compared to 81,850.50 points from the last working day. Such fluctuations in the stock market can be concerning for investors, as they reflect the overall health of the economy.

During the trading session, a total of 369,620,812 shares were exchanged, which is a decrease from the previous day’s trading volume of 400,309,071 shares. The total value of shares traded was Rs 17.062 billion, down from Rs 18.690 billion on the last trading day. This decline in trading activity indicates a cautious approach among investors, who may be waiting for more favorable conditions before making significant moves.

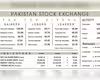

In the stock market, 427 companies participated in trading. Out of these, 127 companies saw their share prices increase, while 246 companies experienced losses. Interestingly, the share prices of 54 companies remained unchanged, suggesting a level of stability amidst the overall decline. The top three trading companies included WorldCall Telecom, which traded 39,357,051 shares at Rs 1.25 per share, Pace (Pak) Limited with 22,589,739 shares at Rs 5.23 per share, and Hub Power Company XD with 21,241,308 shares at Rs 129.09 per share.

Among the companies that saw significant changes in their share prices, Ismail Industries Limited experienced the highest increase, with a rise of Rs 146.54 per share, closing at Rs 1,896.67. Rafhan Maize Products Company Limited followed closely with an increase of Rs 57.50, bringing its share price to Rs 7,300.00. On the other hand, Nestle Pakistan Limited faced the largest decrease, with a drop of Rs 52.05, closing at Rs 6,906.02. Services Industries Limited also saw a decline, with a decrease of Rs 36.23, closing at Rs 1,112.80.

Interestingly, while the PSX faced challenges, global stock markets and oil prices rallied on the same day. This was largely due to China’s central bank announcing new stimulus measures aimed at boosting growth in the world’s second-largest economy. Following a series of disappointing economic data, the central bank decided to cut several interest rates to stimulate growth. As a result, stock markets in Shanghai and Hong Kong surged by more than four percent, marking one of the most significant measures taken in years.

In Europe, the Paris stock market led the way with a gain of 1.6 percent, driven by optimism in the luxury fashion sector due to anticipated demand recovery in China. Frankfurt and London also saw modest gains, despite some negative news regarding German business confidence. Oil prices increased by more than two percent, reflecting the positive sentiment in the commodities market.

Experts believe that China’s stimulus measures could benefit commodity producers and companies linked to the Chinese market. However, some analysts caution that while these measures are a step in the right direction, they may not be sufficient for a full economic recovery. The head of China economics at Capital Economics noted that more substantial fiscal support is necessary for a complete rebound.

As the PSX continues to navigate through these turbulent waters, investors are advised to stay informed and consider the broader economic indicators. The recent trends in global markets may provide some hope, but caution remains key. Understanding the dynamics of both local and international markets can help investors make more informed decisions in these uncertain times.