Wednesday, October 16, 2024 08:52 AM

Sales Tax Evasion: Aurangzeb Highlights 50% Tax Leakage in Pakistan

- Sales tax evasion accounts for 50% of tax leakage.

- Government faces Rs7 trillion in tax leakage.

- Urgent need for a fact-based dialogue on tax fraud.

Image Credits: dawn.com

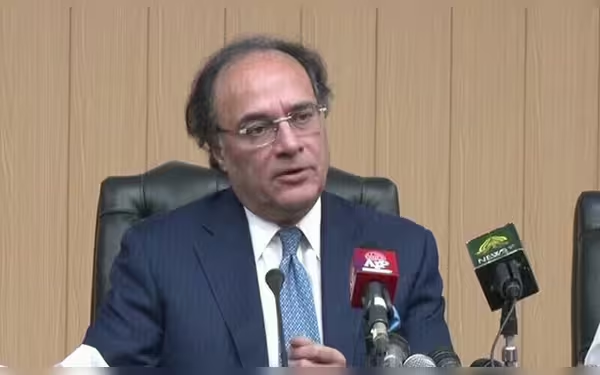

Image Credits: dawn.comFinance Minister Aurangzeb reveals sales tax evasion causes 50% of Pakistan's Rs7 trillion tax leakage, urging a fact-based dialogue.

In recent discussions surrounding Pakistan's financial landscape, the issue of tax evasion has taken center stage. The government has been grappling with significant tax leakage, which has been estimated at a staggering Rs7 trillion. This situation has raised alarms among policymakers and economists alike, as it directly impacts the country’s ability to fund essential services and infrastructure development.

On Thursday, Finance Minister Muhammad Aurangzeb shed light on a critical aspect of this issue: sales tax evasion. According to the minister, companies are responsible for a shocking 50 per cent of the tax leakage due to their fraudulent practices. This revelation underscores the urgent need for a comprehensive approach to tackle tax fraud in the country.

During a presentation, Aurangzeb emphasized the importance of having a “fact-based” discussion regarding tax fraud. He pointed out that without accurate data and a clear understanding of the problem, efforts to combat tax evasion would be ineffective. The finance minister's call for a fact-based dialogue is a step in the right direction, as it encourages transparency and accountability among businesses.

Tax evasion not only deprives the government of much-needed revenue but also places an unfair burden on honest taxpayers. When companies evade taxes, the government has to find alternative ways to fill the financial gap, often leading to increased taxes for the general public. This cycle can create a sense of injustice and frustration among citizens who comply with tax regulations.

Moreover, the impact of tax evasion extends beyond just financial losses. It can hinder economic growth and development, as the government struggles to invest in critical areas such as education, healthcare, and infrastructure. Therefore, addressing this issue is not just about collecting taxes; it is about ensuring a fair and equitable system for all.

The statements made by Finance Minister Aurangzeb highlight a pressing issue that requires immediate attention. Tackling sales tax evasion is essential for the financial health of Pakistan. By fostering a culture of compliance and accountability, the government can work towards reducing tax leakage and ensuring that resources are available for the betterment of society. It is crucial for all stakeholders, including businesses and the government, to collaborate in creating a fair tax system that benefits everyone.