Saturday, November 16, 2024 07:51 PM

Pakistani Rupee Marginally Appreciates Against US Dollar

- Rupee gains 0.05% against US dollar in inter-bank market.

- US dollar declines due to labor market weakness.

- Oil prices retreat but remain set for weekly gains.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee appreciates 0.05% against the US dollar amid global currency fluctuations and oil price changes.

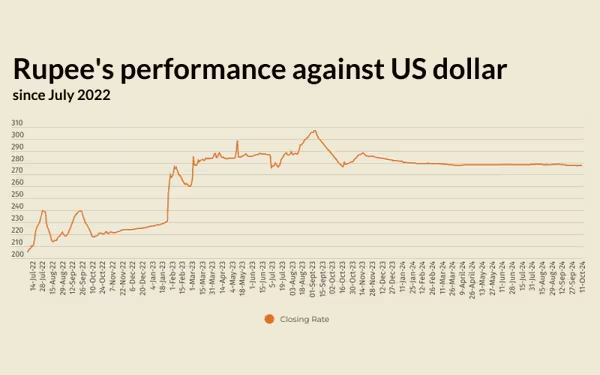

The Pakistani rupee has shown a slight improvement against the US dollar, marking a 0.05% appreciation in the inter-bank market on Friday. This change is significant, as it reflects the ongoing fluctuations in currency values that can impact the economy. At the end of the trading day, the rupee settled at 277.64, gaining Re0.15 against the greenback. This follows Thursday's closing rate of 277.79, as reported by the State Bank of Pakistan (SBP).

Globally, the US dollar experienced a decline from two-month highs reached earlier, primarily due to emerging signs of weakness in the labor market. These signs have led to speculation about potential quicker rate cuts by the Federal Reserve. Despite this, the dollar remained on track for a second consecutive weekly advance, following unexpectedly strong monthly payroll figures that have led traders to reconsider their bets on a half-percentage-point cut at the Fed’s upcoming policy meeting.

The market's reaction to the surge in initial jobless claims was further complicated by an increase in the consumer price index (CPI) on the same day. This situation serves as a reminder that a restrictive monetary policy may still be necessary to control inflation. As of 0111 GMT, the dollar index, which measures the currency against six major peers, was flat at 102.84, but it had decreased by 0.3% from 103.17 on Thursday, which was its highest level since August 15. For the week, the index is poised for a 0.39% advance, building on the previous week’s impressive 2.06% surge.

In the realm of oil prices, which are crucial indicators for currency values, there was a retreat on Friday after a higher settlement the previous day. However, prices are still set for a second weekly gain as investors weigh the potential impact of hurricane damage on US demand against the possibility of broader supply disruptions if Israel were to attack Iranian oil sites. Brent crude oil futures fell by 94 cents, or 1.2%, to $78.46 a barrel, while US West Texas Intermediate crude futures slipped by 86 cents, or 1.1%, to $74.99 per barrel. Both benchmarks are expected to show gains for the week.

In the open market, the Pakistani rupee experienced a slight decline of 5 paise for buying against the US dollar, while the selling rate remained unchanged. The rupee closed at 278.15 for buying and 279.59 for selling. Against the Euro, the rupee gained 45 paise for buying and 43 paise for selling, closing at 301.83 and 304.67, respectively. When compared to the UAE Dirham, the rupee gained 5 paise for both buying and selling, closing at 75.32 and 76.01, respectively. However, against the Saudi Riyal, the rupee lost 1 paisa for buying but gained 1 paisa for selling, closing at 73.52 and 74.17, respectively.

The recent movements in the currency market highlight the interconnectedness of global economic factors and local currency performance. As the Pakistani rupee shows signs of strength, it is essential for stakeholders to remain vigilant and informed about ongoing developments. Understanding these fluctuations can help individuals and businesses make better financial decisions in an ever-changing economic landscape.