Thursday, July 4, 2024 07:42 PM

Supreme Court of Pakistan clarifies tax rebate calculation

- Dismissed appeals on tax rebate interpretation

- Rebate reduces tax rate by 6.25%

- Ends 67-year controversy over tax rebate clause

Image Credits: Business Recorder

Image Credits: Business RecorderThe Supreme Court of Pakistan settles a long-standing dispute over tax rebate calculation under the Double Tax Treaty with the United States, providing clarity and ending decades of confusion for US companies.

The Supreme Court of Pakistan has recently made a significant decision regarding the interpretation of Article VI of the 'Convention between the Government of Pakistan and the Government of the United States of America for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income'. The apex court dismissed appeals against the High Court of Sindh and the Lahore High Court's rulings, clarifying the calculation of tax rebates.

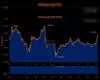

The crux of the matter revolved around the interpretation of the rebate provision in Article VI, which reduces the tax rate by 1 anna in the rupee, equivalent to 6.25%. The appellants argued for a different calculation, contending that the rate should be reduced to 14.0625% instead of 8.75%. However, the Supreme Court upheld the original interpretation, emphasizing that the rebate applies to the tax rate, not the tax amount.

This ruling brings an end to a longstanding controversy that dates back to the signing of the treaty in 1957. The dispute over the correct application of the tax rebate clause had led to legal battles spanning 67 years, causing confusion and unnecessary legal expenses for US companies involved.

In conclusion, the Supreme Court's decision provides clarity on the calculation of tax rebates under the Double Tax Treaty between Pakistan and the United States. The judgment reaffirms that the rebate reduces the tax rate by 6.25%, settling a contentious issue that has plagued the tax department and affected US companies for decades.