Sunday, July 7, 2024 11:02 AM

Supreme Court's Tax Ruling Sparks Legal Debate

- Judgement on tax levy (7E) questioned by legal experts

- Emphasis on broad discretion and equality in tax classification

- Exploration of income definition and complexities in tax law

Image Credits: slate.com

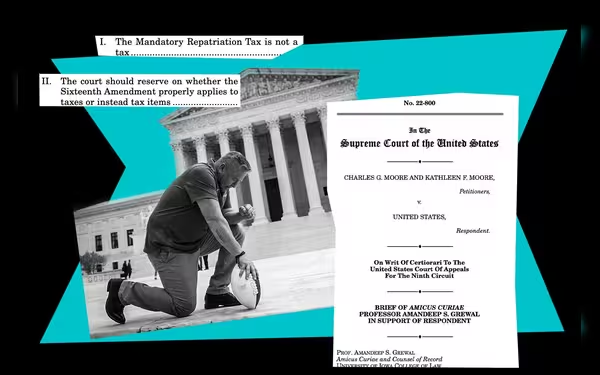

Image Credits: slate.comThe recent Supreme Court ruling on tax levy (7E) prompts legal debate, emphasizing broad discretion in taxation and complexities in income determination.

The recent judgement on the levy of tax (7E) has sparked a debate among legal experts, with some questioning its alignment with existing laws. The order draws parallels to previous cases, such as the Maulvi Tamizuddin Khan case, raising concerns about its validity under specific entries in the list.

Delving into the intricacies of income taxation, the Supreme Court's order in the Elahi Cotton case sheds light on key principles. It emphasizes the broad discretion enjoyed by the legislature in tax matters, while also highlighting the importance of equality in classification for tax purposes. The order underscores the dynamic and pragmatic approach required in interpreting constitutional provisions related to taxation.

Furthermore, the definition of 'income' is explored in detail, emphasizing that it encompasses not just received profits but also savings derived from personal use of assets. The complexities of income determination and the impact of deeming provisions in tax statutes are also discussed, providing valuable insights into the nuances of tax law.

In conclusion, the Supreme Court's order serves as a reminder of the evolving nature of tax legislation and the need for a balanced approach that upholds constitutional principles while addressing the complexities of modern economic realities.