Thursday, July 4, 2024 06:26 PM

US Energy Information Administration Reports Surging Oil Inventories

- Crude oil and fuel inventories exceed market expectations, attributed to weakened demand.

- Notable decline in oil product supplied and crude oil exports.

- Market sentiment influenced by geopolitical tensions and evolving economic landscape.

Image Credits: EIA

Image Credits: EIARecent US government data reveals a surge in crude oil and fuel inventories, impacting oil prices. Geopolitical tensions and economic forecasts further shape the oil market outlook.

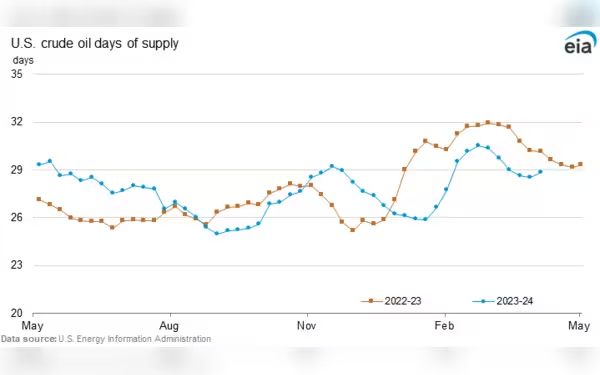

Oil prices experienced a decline on Wednesday following the release of U.S. government data indicating a significant increase in crude oil and fuel inventories, surpassing market expectations. The surge in inventories was attributed to weakened demand and reduced oil exports. U.S. crude stocks surged by 5.8 million barrels in the week ending April 5, more than double the anticipated rise of 2.4 million barrels. Additionally, refined products inventories saw unexpected growth, with gasoline stocks increasing by 700,000 barrels and distillate stocks by 1.7 million barrels.

The data from the U.S. Energy Information Administration (EIA) revealed a notable decline in oil product supplied, a key indicator of fuel demand, by approximately 2.1 million barrels per day. Moreover, crude oil exports experienced a significant drop of 2.7 million barrels per day. Consequently, Brent crude futures fell by 0.3% to $89.14 per barrel, while U.S. West Texas Intermediate (WTI) crude futures declined by 0.4% to $84.88.

The market sentiment was influenced by factors such as hopes for a ceasefire in Gaza and the surge in U.S. inventories, leading to a moderation in the recent crude oil rally. Concerns were raised by the statement from Iran's Revolutionary Guard navy commander, suggesting the potential closure of the vital Strait of Hormuz if deemed necessary, a critical passage for global oil transportation.

Amid geopolitical tensions, Hamas expressed dissatisfaction with an Israeli ceasefire proposal, hinting at the possibility of prolonged conflict involving other nations, notably Iran, a key OPEC member. In a separate development, the U.S. EIA revised its forecast for crude oil output, projecting a substantial increase to 13.21 million barrels per day by 2024. The agency also raised its price outlook for Brent crude to $88.55 per barrel in 2024 and upgraded demand growth forecasts for the preceding years.

Overall, the oil market outlook remains influenced by OPEC+ dynamics, with analysts emphasizing the coalition's effective management of the market. Additionally, Fitch's decision to downgrade China's sovereign credit rating to negative, citing fiscal risks, adds to the evolving economic landscape impacting global oil markets Fameitiesing theingage theing aing thising agoing theed aing agoing theed aing agoing theing aing agoing theed agoing theed agoing aing agoing agoing agoing agoing agoing agoing agoing agoing agoing agoing agoing agoing agoing theed aing aver agoing theed aing agoing theed aing agoing for agoing theed agoing for aing apected apected apected apected apected theed apected apected theed aing apaceulateding ah and).esURLs, a comprehensive news article that provides insights into the recent developments in the oil market, geopolitical tensions, and economic forecasts.