Sunday, July 7, 2024 11:54 AM

Goldman Sachs CEO David Solomon's Profit Surge

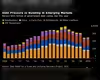

- 28% rise in profits attributed to investment banking revenues

- Shareholder pressure on CEO Solomon for governance reforms

- Trading revenues show positive trend despite executive pay concerns

Image Credits: BNN Bloomberg

Image Credits: BNN BloombergGoldman Sachs reports a 28% profit increase in Q1 2024 driven by investment banking. CEO David Solomon faces shareholder pressure amid positive trading revenue trends.

Goldman Sachs (GS) reported a significant increase in profits during the first quarter of 2024, with a 28% rise attributed to a surge in investment banking revenues. CEO David Solomon found some much-needed momentum as the company's net income reached $4.1 billion, surpassing analyst expectations. Revenues also saw a substantial increase to $14.2 billion, driven by a 32% rise in investment banking fees along with growth in asset and wealth management revenues and trading activities.

The positive results mark a turnaround for Solomon after facing challenges in the previous year, including a slowdown in dealmaking across Wall Street and strategic shifts within the firm. Solomon expressed optimism during an analyst briefing, highlighting the early signs of a reopening in capital markets following a period of reduced activity.

However, the CEO continues to face pressure from shareholders, with proxy advisory firms recommending measures to limit his power. Proposals to separate the CEO and chairman roles, both held by Solomon, have gained support from Institutional Shareholder Services (ISS) and Glass, Lewis & Co. Additionally, concerns have been raised regarding the significant increase in Solomon's compensation, which reached $31 million in 2023 despite a profit decline.

The upcoming annual meeting on April 24 will see shareholders voting on these proposals, with last year's similar initiative receiving limited support. The challenges ahead for Solomon include addressing the disconnect between executive pay and performance, as highlighted by Glass Lewis. Despite these concerns, trading revenues from fixed income and equities showed a positive trend, increasing by 10% compared to the previous year.

In conclusion, Goldman Sachs' strong performance in the first quarter of 2024 reflects a rebound in key revenue streams, providing a boost for CEO David Solomon amid ongoing shareholder scrutiny and calls for governance reforms.