Sunday, July 7, 2024 11:27 AM

Japan's Cabinet Office reports decline in core machinery orders

- First decrease in three months raises concerns about capital spending

- Bank of Japan's policy shift adds complexity to economic landscape

- Manufacturers experience significant drop while non-manufacturers see increase

Image Credits: channelnewsasia

Image Credits: channelnewsasiaJapan's core machinery orders decline in April, raising concerns about capital spending and reflecting complex economic dynamics. Despite challenges, there are signs of resilience and adaptability in the sector.

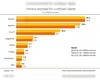

Japan's core machinery orders experienced a decline in April, marking the first decrease in three months, as reported by the Cabinet Office. This development has sparked worries about the strength of capital spending, a key factor for ensuring a sustainable economic recovery in the country. The recent decision by the Bank of Japan to scale back its extensive bond purchases indicates a shift in monetary policy, adding to the economic landscape's complexity.

The data revealed a 2.9% month-on-month drop in core orders for April, deviating from the economists' forecast of a 3.1% decline. While this information is considered volatile, it serves as a crucial indicator for predicting future trends in capital spending.

Despite the decline in machinery orders, the Cabinet Office remains cautiously optimistic, noting signs of improvement within the sector. Japanese companies, known for planning substantial investments in infrastructure and equipment, sometimes postpone these initiatives due to economic uncertainties. Surprisingly, the depreciation of the yen has not significantly encouraged domestic capital investment, with many firms opting to invest in foreign markets with higher demand.

In April, manufacturers witnessed an 11.3% month-on-month decrease in core orders, while non-manufacturers saw a 5.9% increase during the same period. This shift contrasts with the previous month's data, where manufacturers enjoyed a 19.4% surge while non-manufacturers faced an 11.3% decline. Year-on-year, core orders in April showed a modest 0.7% increase, reflecting a nuanced trend in the sector.

The fluctuation in Japan's core machinery orders underscores the intricate dynamics of the country's economic landscape. While challenges persist, there are glimpses of resilience and adaptability within the sector. As Japan navigates through these uncertainties, a balanced approach to capital spending and investment strategies will be crucial for fostering sustainable growth and stability in the long run.