Tuesday, July 2, 2024 03:12 PM

National Savings Increases Regular Income Certificates Profit Rate

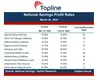

- Regular Income Certificates profit rate raised to 14.64% by National Savings

- Investors to receive Rs. 1,220 monthly from May 14, 2024

- Regular Income Certificates exempt from Zakat deduction, offering stable returns

Image Credits: pakobserver

Image Credits: pakobserverNational Savings, also known as Qaumi Bachat Bank, raises profit rate for Regular Income Certificates to 14.64%. Investors to receive Rs. 1,220 monthly from May 14, 2024. Certificates exempt from Zakat deduction, providing stable returns.

National Savings, also known as Qaumi Bachat Bank, has recently announced a revision in the profit rates of its financial products, specifically the Regular Income Certificates. This adjustment, effective from May 14, 2024, sets the new profit rate for Regular Income Certificates at 14.64 percent. These certificates were initially introduced by the government in February 1993 to assist the public in meeting their monthly financial requirements.

The Regular Income Certificates have a maturity period of five years and are available in denominations ranging from Rs. 50,000 to Rs. 10,000,000. Investors who opt for these certificates start receiving monthly profits from the date of issuance. With the recent policy update, the profit rate for Regular Income Certificates has been increased to 14.64% per annum. This means that investors will now receive Rs. 1,220 per month, starting from May 14, 2024.

One significant advantage of investing in Regular Income Certificates is that the invested amount is exempt from Zakat deduction. This exemption makes these certificates an attractive investment choice for individuals looking for a steady income stream with minimal tax implications.

The adjustment in profit rates for Regular Income Certificates by National Savings presents a lucrative opportunity for investors seeking stable returns. With the increased profit rate and the exemption from Zakat deduction, these certificates offer a reliable investment avenue for individuals looking to secure their financial future.