Thursday, November 7, 2024 07:37 AM

Pakistani Rupee Sees Minor Gain Against US Dollar

- Rupee appreciates 0.05% to 277.70 against USD.

- Oil prices rise amid geopolitical tensions.

- US dollar remains steady ahead of jobs report.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee shows a slight improvement against the US dollar, closing at 277.70 in the inter-bank market.

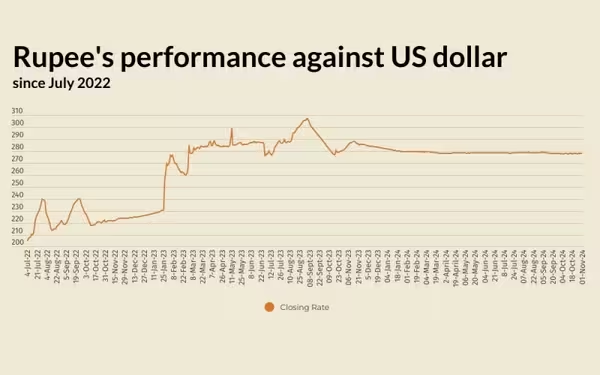

The Pakistani rupee has shown a slight improvement against the US dollar, marking a 0.05% appreciation in the inter-bank market on Friday. This positive movement is a welcome change for many, as the currency settled at 277.70, gaining Re0.15 against the greenback. Just a day earlier, the rupee had closed at 277.85, according to the State Bank of Pakistan (SBP).

On the international front, the US dollar remained steady against major currencies as investors eagerly awaited the US jobs report. This report is crucial as it will provide insights into the economic resilience of the United States, especially with the Federal Reserve's monetary policy meeting approaching and a closely contested presidential election on the horizon.

Interestingly, the US dollar began October on a weaker note after facing pressure against the yen. However, it has seen significant monthly gains, the largest since September 2022. This shift is attributed to investors reassessing their expectations regarding aggressive rate cuts by the Federal Reserve and considering the implications of the upcoming US elections.

Recent data indicates that upward price pressures are easing, which supports the notion that the Federal Reserve may opt to cut interest rates by 25 basis points in their next meeting. The US dollar index, which tracks the performance of the dollar against six major currencies, rose by 0.06% to reach 103.94.

In terms of oil prices, which are a key indicator of currency parity, there has been a notable increase. Oil prices climbed more than $1 a barrel on Friday, recovering from weekly losses. This rise follows reports that Iran is preparing for a retaliatory strike on Israel from Iraq in the coming days. As a result, Brent crude futures increased by $1.39, or 1.9%, reaching $74.20 a barrel, while US West Texas Intermediate crude rose by $1.44, or 2.1%, to $70.70.

In the open market, the Pakistani rupee gained 7 paise for buying and 15 paise for selling against the US dollar, closing at 276.80 and 278.63, respectively. However, against the Euro, the rupee lost 56 paise for buying and 58 paise for selling, closing at 299.74 and 302.52, respectively. The rupee also gained 1 paisa against the UAE Dirham for both buying and selling, closing at 75.26 and 75.96, respectively. Conversely, against the Saudi Riyal, the rupee remained unchanged for buying but lost 1 paisa for selling, closing at 73.52 and 74.16, respectively.

While the marginal improvement of the Pakistani rupee against the US dollar is a positive sign, it is essential to remain cautious. The global economic landscape is ever-changing, and factors such as international oil prices and upcoming economic reports can significantly impact currency values. For individuals and businesses alike, staying informed about these developments is crucial for making sound financial decisions.