Saturday, November 16, 2024 08:38 PM

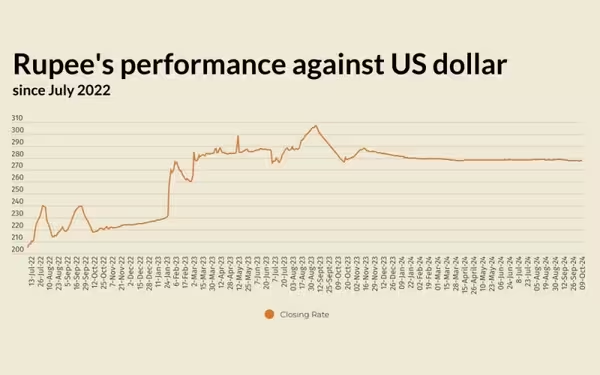

Pakistani Rupee Declines Against US Dollar Amid Economic Fluctuations

- Pakistani rupee ends at 277.72 against US dollar.

- Oil prices decline, impacting currency parity.

- Market anticipates Federal Reserve's interest rate decisions.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee marginally weakens against the US dollar, closing at 277.72 amid fluctuating oil prices and interest rate speculations.

The Pakistani rupee has recently shown a slight decline against the US dollar, ending the trading session on Wednesday at 277.72. This represents a depreciation of 0.02%, or a loss of Re0.05, compared to the previous day's closing rate of 277.67, as reported by the State Bank of Pakistan (SBP). Such fluctuations in currency values are not uncommon, especially in the context of global economic trends and local market conditions.

On the international front, the US dollar has been relatively stable, providing some relief to other major currencies, including the Japanese yen. This stability comes after the dollar experienced a significant rally, reaching a seven-week high last week. Investors are currently taking a moment to evaluate the future of interest rates in the United States, particularly in light of the upcoming release of the minutes from the Federal Reserve's September meeting. These minutes are expected to reveal discussions regarding the labor market, which had shown signs of deterioration at that time.

Interestingly, while there was initial speculation about a potential 50-basis point cut in interest rates, recent nonfarm payroll data suggests a more resilient labor market, leading to a shift in expectations. Currently, markets are pricing in an 85% chance of a quarter basis point reduction, with a slim possibility that the Federal Reserve may choose to keep rates unchanged.

In terms of oil prices, which are a crucial factor in determining currency parity, there has been a notable decline. On Wednesday, Brent crude futures fell by 36 cents to $76.82 a barrel, while U.S. West Texas Intermediate (WTI) futures dropped by 43 cents to $73.14. This decline is attributed to weak demand fundamentals and rising supply, despite concerns over potential supply disruptions due to ongoing conflicts in the Middle East and Hurricane Milton in the United States.

In the open market, the Pakistani rupee experienced a slight gain against the US dollar, closing at 278.17 for buying and 279.61 for selling. Additionally, the rupee gained against the Euro, closing at 302.89 for buying and 305.66 for selling. However, it remained unchanged against the UAE Dirham and saw a minor gain against the Saudi Riyal for selling.

The fluctuations in the value of the Pakistani rupee against the US dollar reflect a complex interplay of local and international economic factors. As investors and market participants continue to monitor these developments, it is essential to stay informed about the broader economic landscape. Understanding these dynamics can help individuals and businesses make more informed financial decisions in an ever-changing market.