Tuesday, July 2, 2024 03:37 PM

RBA Faces Decision on Interest Rates Amidst Market Fluctuations

- Mining and gold sectors show gains, banking stocks face losses

- Investors cautious ahead of Australia's CPI data release

- Market stability amidst sectoral fluctuations reflects cautious optimism

Image Credits: brecorder

Image Credits: brecorderAustralian stocks show mixed performance as mining and gold sectors gain while banking stocks decline. Investor caution prevails ahead of CPI data release and potential RBA interest rate adjustments.

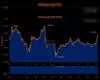

Australian stocks traded with limited movement on Tuesday, with the mining and gold sectors showing gains while banking stocks faced losses. Investor sentiment remained cautious as the market awaited the release of Australia's consumer price inflation (CPI) data for April, scheduled for Wednesday. The Reserve Bank of Australia (RBA) recently decided to maintain interest rates unchanged, emphasizing the importance of stability in policy decisions. However, the possibility of a rate hike looms if inflation figures do not align with expectations. Economists anticipate a slight dip in CPI to 3.4% from the previous month's 3.5%, with a particular focus on the goods component's impact on inflation trends.

Mining stocks experienced a modest 0.5% increase, with BHP Group leading the gains with a nearly 0.6% rise. The gold sub-index also saw a 0.9% uptick following a 1% surge in gold prices driven by evolving expectations regarding US interest rate adjustments. Conversely, financial stocks, sensitive to interest rate shifts, declined by 0.2%, with Commonwealth Bank of Australia and Westpac registering slight decreases. The healthcare and technology sectors also witnessed declines of approximately 0.4% and 0.3%, respectively.

Across the Tasman Sea, New Zealand's S&P/NZX 50 index edged up to 11,763.89, with the upcoming government budget announcement expected to reveal a deepening fiscal deficit for the country.

The Australian stock market's stability amidst sectoral fluctuations reflects the cautious optimism prevailing among investors. As anticipation builds for the CPI data release and potential interest rate adjustments by the RBA, market participants are closely monitoring economic indicators for signals of future market trends. The interconnectedness of global economic factors, as evidenced by the impact of US rate expectations on gold prices, underscores the need for a comprehensive understanding of market dynamics. Stay informed to make informed investment decisions in this dynamic financial landscape.