Thursday, July 4, 2024 06:33 PM

Bank Indonesia Raises Interest Rates Amid Rupiah Weakness

- Interest rates raised to highest level in seven years

- Preemptive measure to maintain inflation within target range

- Likelihood of further rate hikes if rupiah continues to depreciate

Image Credits: Bloomberg

Image Credits: BloombergBank Indonesia surprises markets with interest rate hike to combat rupiah depreciation and inflation, signaling proactive stance in uncertain global economy.

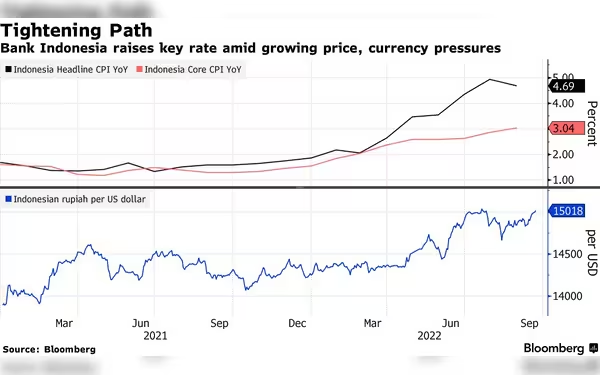

Indonesia's central bank surprised markets by raising interest rates to their highest level in seven years in a bid to bolster the weakening rupiah against the US dollar. The move saw the seven-day reverse repurchase rate increased by 25 basis points to 6.25 percent, a level last seen in 2016, contrary to economists' expectations of a hold at six percent.

Bank Indonesia Governor Perry Warjiyo explained that the rate hike aimed to enhance the rupiah's exchange rate stability amidst escalating global risks, particularly driven by the aftermath of Russia's invasion of Ukraine. The surge in inflation, attributed to rising energy and food prices, supply chain disruptions, and pandemic-related economic challenges, prompted central banks worldwide, including Bank Indonesia, to tighten monetary policies post-Covid-19.

Warjiyo emphasized that the preemptive measure was essential to maintain inflation within the bank's target range of 1.5-3.5 percent, with the current rate standing at 3.05 percent. Despite the rupiah's relative strength compared to regional currencies against the US dollar, a depreciation of over five percent since the year's onset necessitated interventions to support the currency.

Economists foresee further tightening by Bank Indonesia if the rupiah continues to depreciate. Gareth Leather, a senior Asia economist at Capital Economics, highlighted the likelihood of additional rate hikes in response to persistent currency weakness, deviating from the anticipated strategy of continued foreign exchange market interventions.

In conclusion, the unexpected interest rate hike by Bank Indonesia underscores the proactive approach taken to mitigate economic uncertainties and maintain exchange rate stability amidst global challenges, positioning the central bank to respond decisively to evolving market conditions.