Thursday, July 4, 2024 06:08 PM

Tesla's Stock Plummets Amid Global Price Cuts

- Tesla reduces prices to boost demand, causing stock drop

- Analysts predict revenue decline and low gross margin for Tesla

- Market reacts negatively to Musk's strategic decisions and controversies

Image Credits: Reuters

Image Credits: ReutersTesla faces stock decline after global price cuts, revenue concerns, and market skepticism towards Musk's strategies.

Tesla's stock price took a hit on Monday, dropping by 4% following the company's announcement of global price cuts. The electric vehicle maker reduced prices by up to $2,000 on models like the Model 3 and Model Y in key markets such as the U.S., China, and Germany. This move was aimed at stimulating demand, which had been sluggish due to high interest rates.

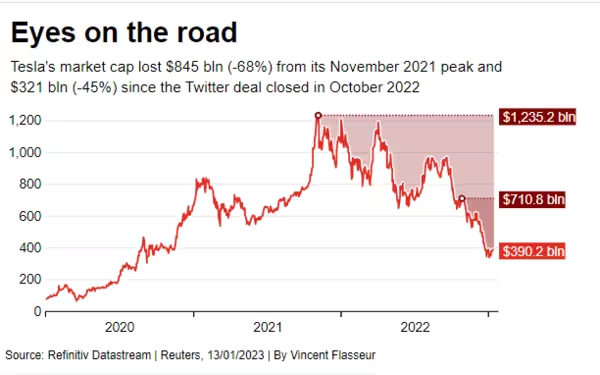

Investors are now concerned about Tesla's profit margins as the company prepares to release its quarterly earnings report. Analysts predict that Tesla may experience its first revenue decline and its lowest gross margin in nearly four years. CEO Elon Musk's recent decision to lay off 10% of the workforce and focus on autonomous driving has added to the uncertainty surrounding the company's future strategy.

Despite Musk's denial of reports about shelving plans for an affordable electric vehicle in favor of robotaxis, the market response has been negative. Tesla's shares have already lost 41% of their value this year, with concerns over Musk's political affiliations and controversial statements deterring potential buyers.

While Tesla remains the most valuable automaker globally, Toyota has been gaining ground, particularly due to the increasing demand for its hybrid vehicles. The market reaction to Tesla's latest price cuts is expected to impact the company's market value significantly, potentially wiping out nearly $20 billion from its current valuation.