Tuesday, July 2, 2024 03:09 PM

CBOT Reports Decrease in Wheat Futures Amid Global Harvest Trends

- Chicago wheat futures decline due to ongoing harvest activities and production forecasts

- Global developments impact market sentiment, with Russia and Ukraine raising crop forecasts

- Commodity funds net buyers of corn and soybean futures, net sellers of wheat contracts

Image Credits: brecorder

Image Credits: brecorderChicago wheat futures saw a slight decrease due to ongoing harvest activities and increased production forecasts. Global developments, including Russia and Ukraine raising crop forecasts, impacted market sentiment. Commodity funds were net buyers of corn and soybean futures, while wheat contracts were sold. Staying informed about evolving conditions and market trends is crucial for making informed decisions in the agricultural sector.

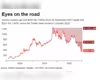

Chicago wheat futures saw a slight decrease on Thursday as ongoing harvest activities in the United States and other major exporting countries, coupled with increased production forecasts, impacted market sentiment. The September contract hit a two-month low, reflecting the current market conditions. Similarly, corn and soybean futures also experienced a dip, attributed to easing concerns about a potential heatwave affecting US crops.

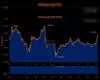

Following a public holiday, the Chicago Board of Trade (CBOT) reported soft red winter wheat down by 0.1% at $5.98-1/2 a bushel. Soybeans dipped by 0.1% to $11.73-1/4 a bushel, while corn traded 0.6% lower at $4.47-1/2 a bushel. Market analysts suggest that while grains are striving to stabilize post recent price declines, there remains a possibility of further downward movement in the short term.

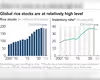

Global developments also played a role in shaping market dynamics. Russia, the world's largest wheat exporter, raised its wheat crop forecast to 82 million metric tons. This upward revision, along with improved soil moisture levels in key Ukrainian cropping regions, led to a slight increase in corn production estimates. In Argentina, despite localized dryness, favorable wheat prices and reduced input costs have incentivized more farmers to cultivate the crop.

Looking ahead, Germany anticipates a 5.5% year-on-year decrease in its 2024 wheat crop, with recent rainfall expected to have minimal impact. Meanwhile, the US Midwest is bracing for a heatwave, sparking concerns about corn and soy crops in the eastern Corn Belt. However, experts believe that the plants, still in the vegetative growth stage, should be relatively resilient to the heat stress.

Commodity funds were noted as net buyers of CBOT corn, soybean, soymeal, and soyoil futures contracts, while acting as net sellers of wheat contracts. The market remains vigilant, closely monitoring global production forecasts and weather patterns to gauge future price trends.

The fluctuations in Chicago wheat futures, influenced by harvest progress, production forecasts, and global agricultural developments, underscore the intricate interplay of factors shaping commodity markets. As stakeholders navigate these dynamics, staying informed about evolving conditions and market trends becomes crucial for making informed decisions in the agricultural sector.