Saturday, November 16, 2024 07:45 PM

Pakistani Rupee Gains Slightly Against US Dollar

- Rupee appreciates by 0.03% against US dollar.

- Federal Reserve signals cautious approach on interest rates.

- Oil prices decline, impacting global economic outlook.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee shows a slight gain against the US dollar amid global economic shifts and Federal Reserve policies.

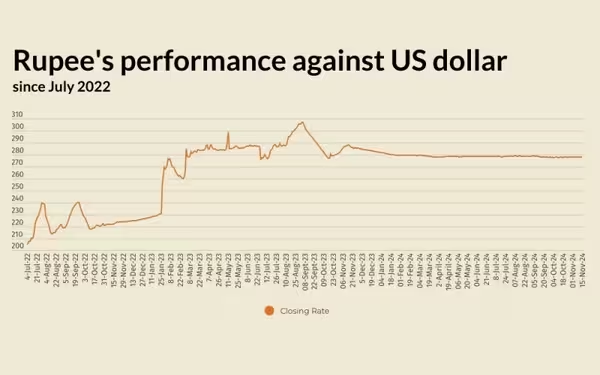

The Pakistani rupee has shown a slight improvement against the US dollar, marking a notable moment in the inter-bank market. On Friday, the currency appreciated by 0.03%, closing at 277.67. This represents a gain of Re0.07 against the greenback, which had settled at 277.74 the previous day, according to the State Bank of Pakistan (SBP).

In the broader international context, the US dollar is experiencing a strong week, buoyed by expectations that the Federal Reserve may not cut interest rates as aggressively as previously thought. This sentiment is further fueled by the anticipation of Donald Trump’s return to office in January, which many believe could lead to increased inflation. The dollar is currently hovering near a one-year high against a basket of currencies, standing at 106.88, and is on track for a weekly gain of 1.8%, marking its best performance since September.

Federal Reserve Chair Jerome Powell indicated that the central bank does not need to rush into lowering interest rates, citing ongoing economic growth, a solid job market, and persistent inflation as reasons for a cautious approach. As a result, traders have adjusted their expectations regarding future rate cuts, with Fed funds futures now suggesting only 71 basis points of easing by the end of 2025. The likelihood of a 25 basis point rate cut next month has also decreased significantly, dropping from 82.5% to just 48.3% in a single day, according to the CME FedWatch tool.

Meanwhile, oil prices, which are a crucial indicator of currency parity, fell on Friday, contributing to concerns about the global economy. Brent crude futures dropped by 97 cents, or 1.34%, to $71.59 a barrel, while US West Texas Intermediate crude futures decreased by 94 cents, or 1.37%, to $67.76. For the week, Brent is expected to decline by 3%, and WTI is projected to fall nearly 4%.

In the open market, the Pakistani rupee gained 7 paise for buying and 9 paise for selling against the US dollar, closing at 276.89 and 278.65, respectively. However, against the Euro, the rupee lost 86 paise for buying and 79 paise for selling, closing at 291.10 and 293.80, respectively. The currency remained stable against the UAE Dirham, with no change for buying and a loss of 1 paisa for selling, closing at 75.27 and 75.97, respectively. Similarly, against the Saudi Riyal, the rupee showed no change for both buying and selling, closing at 73.52 and 74.16, respectively.

While the Pakistani rupee has shown a slight gain against the US dollar, the broader economic landscape remains complex. Factors such as international oil prices, Federal Reserve policies, and global economic conditions will continue to influence currency movements. For individuals and businesses alike, staying informed about these developments is crucial for making sound financial decisions.